Bloomin’ Brands (NASDAQ:BLMN) is home to no shortage of fun quick-service restaurant chains, but the fun seems to be wearing thin for some analysts. One in particular turned on the stock after its earnings win came with softening guidance, and that sent Bloomin’ Brands stock down over 2.5% in Monday afternoon’s trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Raymond James, via analyst Brian Vaccaro, lowered the rating on Bloomin’ from Strong Buy to Outperform, noting that there’s still value to be had in Bloomin’, but not quite so much as there once was. Nevertheless, Vaccaro noted the valuation is attractive as the price is currently “depressed.”

Furthermore, Bloomin’ did a fine job with its latest earnings report, bringing in a beat on earnings but a slight miss on revenue. Better yet, earnings were a clear win over this time last year as well, coming in at $0.44 against last year’s $0.35. But Bloomin’ isn’t taking its somewhat softer numbers lying down.

Indeed, it’s planning to boost its advertising spending not only in the fourth quarter but also going into 2024 as well. The boost will be somewhat restrained—it won’t be “…return(ing) to pre-pandemic levels…”—but it will be a boost nonetheless as it seeks a marketing mix that helps drive traffic.

What is BLMN Stock Price Forecast?

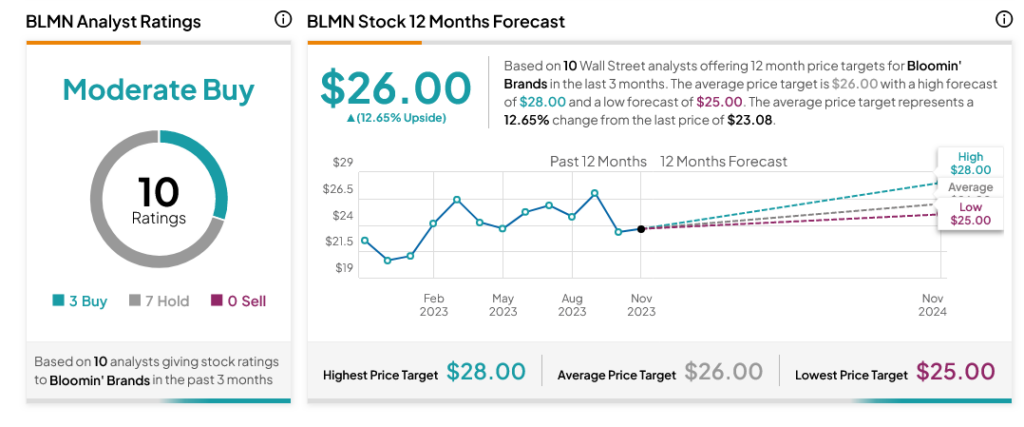

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BLMN stock based on three Buys and seven Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average BLMN price target of $26.00 per share implies 12.65% upside potential.