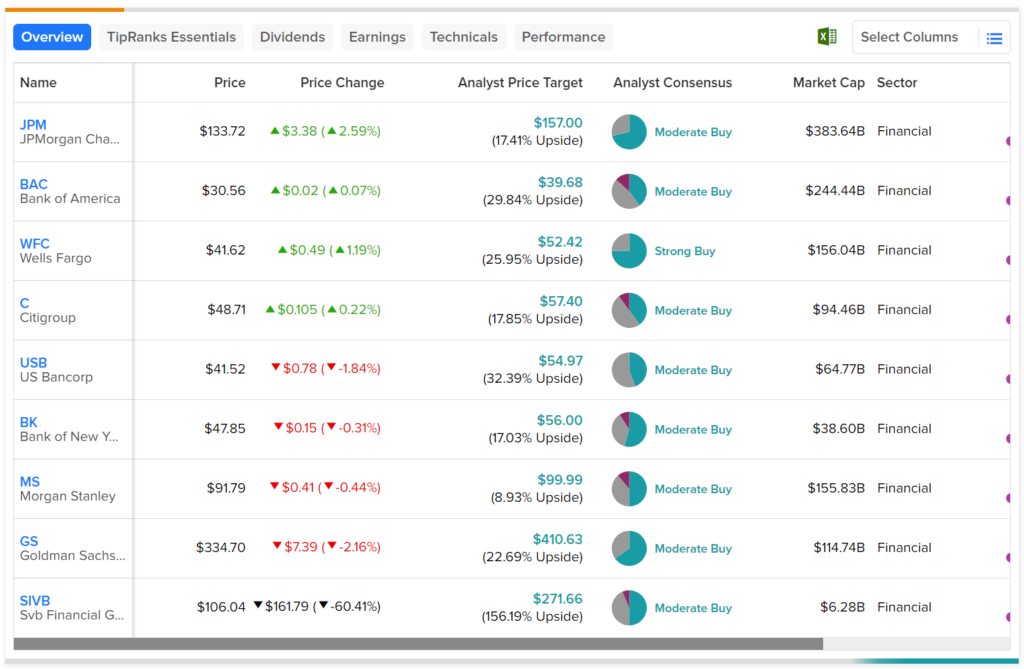

Bank stocks were recently caught up in a broad-based selloff after SVB Financial (SIVB) had difficulty raising money, and Silvergate Capital (SI) announced that it would liquidate. As a result, this sparked fears of systemic weakness. Interestingly though, analysts from major banks have come out to emphasize that this is not the case.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Indeed, Manan Gosalia, Jared Shaw, and Ebrahim Poonawala of Morgan Stanley (MS), Wells Fargo (WFC), and BofA Securities (BAC), respectively, essentially called the selloff an overreaction. They state that the difficulties experienced by SVB and Silvergate are specific to them and not representative of systemic weakness.

Nevertheless, bank stocks are seeing mixed performances so far in today’s trading session. Apart from SVB Financial, most of the stocks included in the image above are either up or down modestly.