Shares of Mobileye (NASDAQ:MBLY) are up today as various Wall Street analysts supported the autonomous driving semiconductor company, despite issues related to China and Tesla (NASDAQ:TSLA) impacting its stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Mizuho Securities analyst Vijay Rakesh advised investors to buy during substantial stock pullbacks, even as he tweaked estimates and his price target after the company dramatically reduced guidance for the year, attributing it to challenges in the Chinese electric vehicle market. Rakesh highlighted strong EyeQ shipments in March and the company’s unwavering 2024 outlook for SuperVision despite short-term hiccups.

Wolfe Research analyst Shreyas Patil upgraded Mobileye to Buy from Hold, noting that although there’s some uncertainty in the short term, the outlook for 2024 and beyond still looks promising. Citi analyst Itay Michaeli shared his optimism about Mobileye’s prospects, emphasizing that the company’s story remains intact, hinting at significant business catalysts in the latter half of the year based on new business commentary.

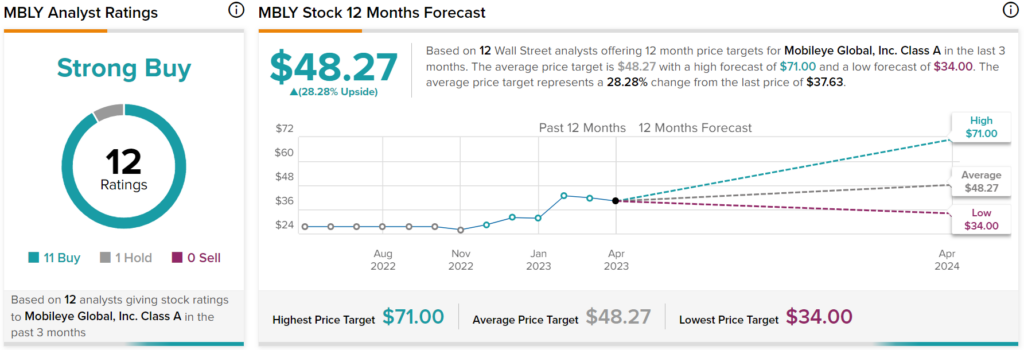

Overall, Wall Street analysts have a consensus price target of $48.27 on MBLY stock, implying over 28% upside potential, as indicated by the graphic above.