Microsoft (MSFT) stock has gained over 11% year-to-date. The company delivered better-than-expected results for Q4 FY24. However, a slower-than-anticipated growth in the company’s cloud business raised concerns about artificial intelligence (AI) tailwinds. Analysts contend that such short-term concerns do not affect the stock’s long-term potential. Overall, MSFT stock scores a Strong Buy rating from analysts on TipRanks, reflecting their confidence about its sustained growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Microsoft’s Q4 Azure Growth Lagged Expectations

In Q4 FY24, Microsoft reported revenue of $64.7 billion, marking a 16% year-over-year rise in constant currency. Its operating income also grew by 16% to $27.9 billion. For FY24, Microsoft achieved total revenue of $245.1 billion, up 16% on a reported basis from the previous year.

Among its segments, Intelligent Cloud’s revenue increased 19% year-over-year to $28.5 billion in Q4. The cloud segment now represents nearly 45% of Microsoft’s total revenue, underscoring its crucial role in the company’s strategy. The revenue growth in this segment was mainly fueled by a 29% rise in Azure and other cloud services. However, it fell short of market expectations of 31% growth, resulting in a disappointing market reaction to the results.

Microsoft Expects Azure to Pick Pace in H2

Moving ahead, Microsoft expects the consumption patterns from Q4 to persist into the first half of FY25, with AI demand impacted by capacity limitations. Following the recently announced restructuring of business segments, Microsoft expects Q1 FY25 revenue growth from Azure and other cloud services to be around 33% in constant currency, which marks a 1 to 2 percentage points sequential decline from the fiscal fourth quarter.

However, the company expects accelerated Azure growth in the second half of FY25, driven by increased capital investments that will boost AI capacity to meet the rising demand.

Insights from TipRanks’ Bulls Say, Bears Say Tool

According to TipRanks Bulls Say, Bears Say tool, analysts are optimistic about Azure’s growth. Bulls are impressed by the company’s latest financial disclosures and updated guidance numbers for Azure. The update shows that Azure’s revenue increased by 33% year-over-year in constant currency in FY24, up from the previously reported 30%.

Bulls also noted the company’s dominance in the productivity software market and significant capital expenditure that reflects confidence in the prospects ahead.

On the other hand, Bears are worried about the impact of the company’s substantial AI investments on its FY25 operating margin.

Is Microsoft a Buy, Sell, or Hold?

Overall, Wall Street analysts have maintained their bullish stance on MSFT stock, considering the opportunities in Azure AI services.

Analysts from Mizuho believe that Microsoft’s medium- and long-term revenue growth prospects, particularly in generative AI, are underestimated. Meanwhile, Deutsche Bank analysts highlighted that Microsoft is at the forefront of AI monetization through Azure AI services. They expect revenue to grow further as the company expands its capacity.

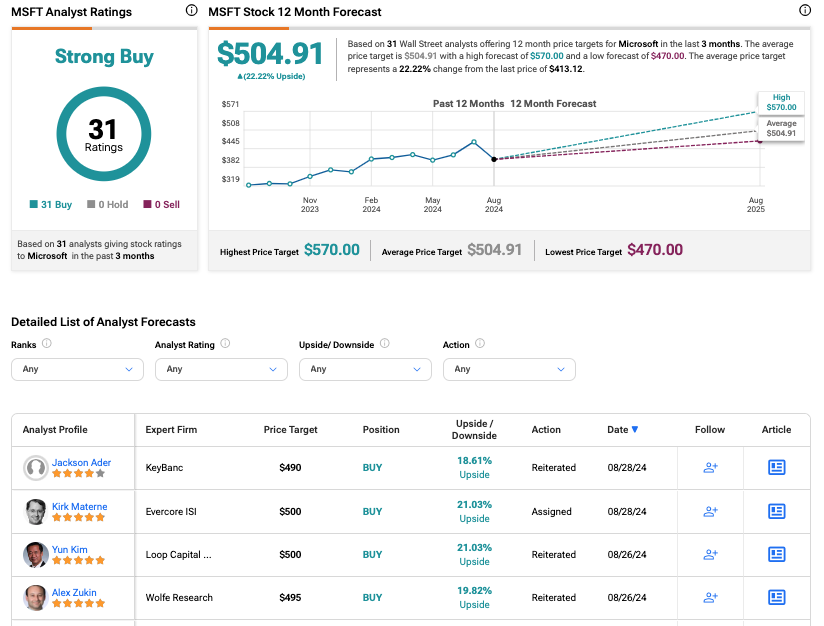

According to TipRanks, MSFT stock has a Strong Buy consensus rating based on 31 unanimous Buy recommendations. The target price for Microsoft stock is $504.91, indicating a potential increase of 22.2% from the current level.

See more MSFT analyst ratings.

Conclusion

Microsoft’s Q4 FY24 earnings highlighted strong financial performance, driven by cloud services and productivity solutions. However, market reactions emphasize the importance of meeting AI growth expectations. The upcoming quarters will be pivotal for reassuring investors. Nonetheless, analysts are highly bullish on the company’s growth potential and its ability to capitalize on AI growth opportunities.