The battle for Disney’s (NYSE:DIS) board took on a whole new dimension after the entertainment giant rolled out an impressive earnings report. With surging profits and new ventures, it’s easy to see new life at Disney. Analysts were also on board, chiming in generally positively as Disney shot up over 12.5% in Thursday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Some analysts talked about how cost-cutting managed to save Disney this quarter but weren’t quite sure this meant a “fundamental turnaround.” Others, like Needham, kept it simple, saying, “The magic’s back.” Needham analyst Laura Martin looked for Disney to keep its churn rates down thanks to bundling. This makes sense, given that bundling gives users more content to sift through before moving on to other venues. As a result, Martin upgraded Disney to Buy and hiked the price target to $120 per share.

Board Drama Gets Tighter

It was strange enough to see Disney bring in Ludwig Von Drake in a bid to maintain the status quo on the board of directors. However, it only got weirder from there as Disney put its eggs in the Taylor Swift basket, hoping some of that magic would rub off. Disney is poised to bring an exclusive version of the Eras Tour to Disney+, and as we recently learned, will contribute to a new sports streaming app that should satisfy all the diehard sports fans out there looking for a place to view all their favorite matchups. All of this combined might make Nelson Peltz’s play for board seats a little harder to support. Ludwig Von Drake was a desperation ploy, high-quality numbers on the earnings report are anything but.

What Is a Good Price for Disney Stock?

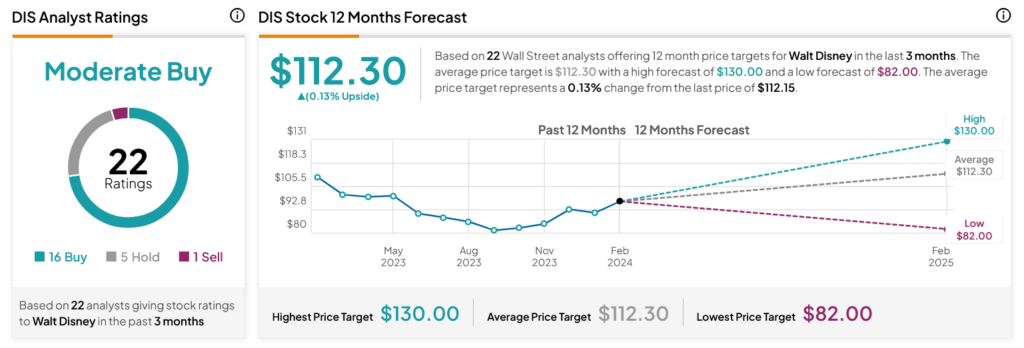

Turning to Wall Street, analysts have a Moderate Buy consensus rating on DIS stock based on 16 Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 1.36% rally in its share price over the past year, the average DIS price target of $112.30 per share implies 0.13% upside potential.