Tech giant Amazon (NASDAQ:AMZN) was up in trading on Friday following the company’s stellar Q3 results, which bolstered confidence in its cloud computing and generative AI ventures. Following the results, top-rated Citi analyst Ronald Josey reaffirmed his Buy rating on Amazon, highlighting the promising prospects of Amazon Web Services and the growing momentum in generative AI.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Amazon generated revenues of $23.06 billion from AWS, with CEO Andy Jassy noting the stabilization in year-over-year growth. The analyst also raised his price target to $177 from $167 earlier, implying an upside potential of 36.4% at current levels.

Even top-rated Monness, Crespi, Hardt analyst Brian White remained bullish on the stock with a Buy rating. In addition, he raised his earnings estimates after the company’s results. The analyst termed the conference call as “positive,” with AWS as the focus.

The analyst commented, “The tone of the call was upbeat, with Amazon demonstrating significantly improved profitability, while optimistic on AI and experiencing continued stabilization at AWS with less pronounced cost optimization efforts.”

White has a $170 price target on the stock, implying an upside potential of 31.7% at current levels.

Is Amazon a Buy, Hold, or Sell?

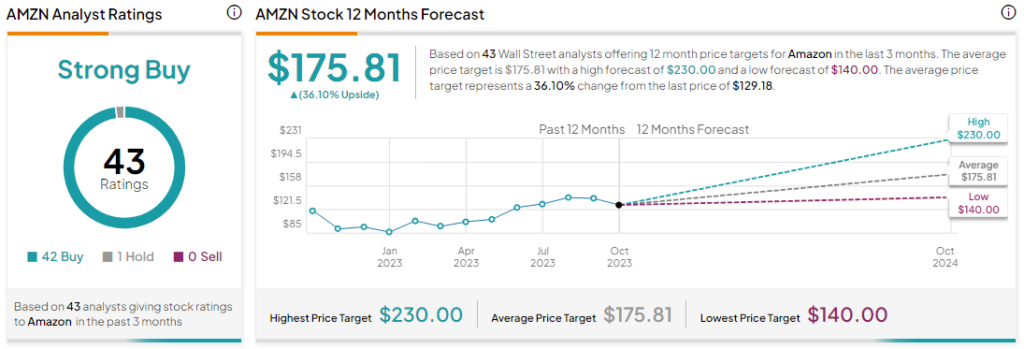

Analysts remain bullish about AMZN with a Strong Buy consensus rating based on 42 Buys and one Hold. The average AMZN price target of $175.81 implies an upside potential of 36.1% at current levels.