Analysts’ recommendations often have a significant impact on share prices, and in Monday afternoon’s trading, we find that biotech stock Moderna (NASDAQ:MRNA) is no different. After an upgrade at UBS, Moderna saw its share price climb into the afternoon. UBS hiked Moderna from Hold to Buy on the strength of its wildly underappreciated product pipeline. According to UBS analyst Eliana Merle, Moderna may have made a name for itself on its COVID-19 treatments, but there’s a whole lot more to Moderna than that which is going to give Moderna its edge going forward, Merle asserts. However, in something of an odd twist, Merle also cut price targets on Moderna, lowering it from $221 to $191 after a closer look at Moderna’s estimates.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Merle elaborates, noting that there are significant risks to Moderna’s COVID-19 treatments. Sure there are; most everyone that wants one has already got it, and there is something of a growing number who are eschewing future treatments, particularly as, for many, COVID-19 starts to look less like a death sentence and more like a bad cold. If you even have symptoms at all. Though Moderna is well off its highs from the time when it gave us a way to fight back against COVID-19, there’s still more coming out that can give this stock its returns.

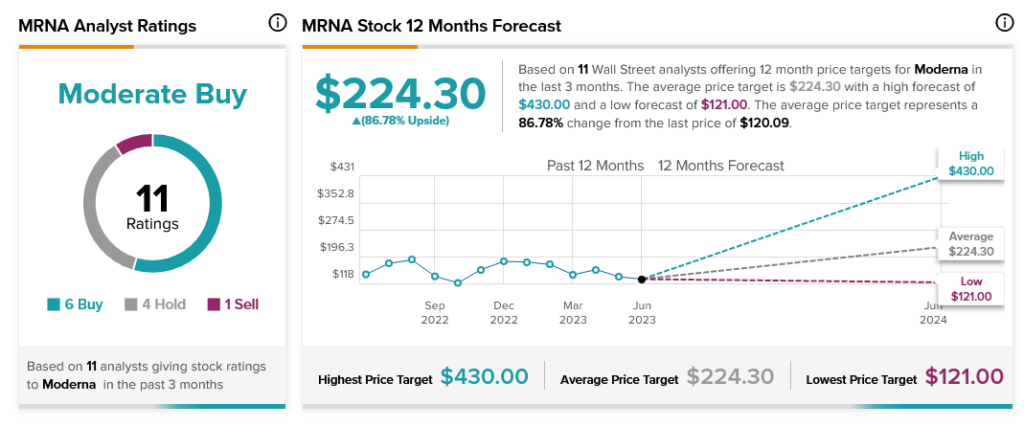

Other analysts, meanwhile, are somewhat more split than Merle is. With six Buy ratings, four Holds, and one Sell, Moderna stock is considered a Moderate Buy. However, Moderna stock also comes with an impressive 86.78% upside potential thanks to its average price target of $224.30 per share.