It was good news for Latin American shopping giant MercadoLibre (NASDAQ:MELI), which managed to pick up some positive analyst sentiment today. And what this analyst had to say caught plenty of attention from investors, who sent shares up over 2% in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The analyst sentiment in question came from Jefferies, where analysts pointed out one absolutely heart-stopping statistic: MercadoLibre’s revenue for Fiscal Year 2024 is likely to be three times what it was in Fiscal Year 2021. The biggest reason? MercadoLibre isn’t so much about buying and selling stuff anymore, as it’s rapidly moving into credit and financial products instead.

That’s prompting a major opportunity; right now, it’s got almost 50 million active financial technology (fintech) users to its credit, but that’s still not even a whole percentage number’s worth of the total market. That’s a massive potential upside, and that’s why Jefferies now has MercadoLibre at a Buy with a $2,100 price target.

Mexican Expansion

Meanwhile, MercadoLibre is eyeing an expansion effort, focusing on Mexico. In fact, MercadoLibre looks to put $2.5 billion into its upcoming Mexican expansion, which will be a record for the company, reports note. That $2.5 billion will have its work cut out for it, though, as it does everything from pay salaries to improve logistics and drive marketing operations. It’s also looking into real estate in the area to ensure that it has enough warehouse facilities to meet its needs.

Is MercadoLibre a Buy, Sell, or Hold?

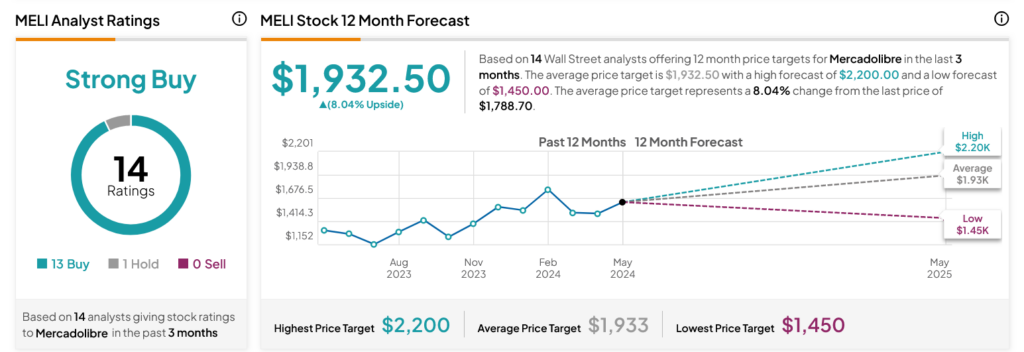

Turning to Wall Street, analysts have a Strong Buy consensus rating on MELI stock based on 13 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 33.13% rally in its share price over the past year, the average MELI price target of $1,932.50 per share implies 8.04% upside potential.