Three major firms have reiterated Sell ratings on Tesla (TSLA) after the company reported strong third-quarter deliveries. Yet, analysts said the rise in numbers was likely driven by a wave of buyers rushing to purchase before the U.S. electric vehicle tax credit expired.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In the meantime, TSLA shares dropped 1.42% on Friday, closing at $429.83.

Analysts Say ‘Sell.’

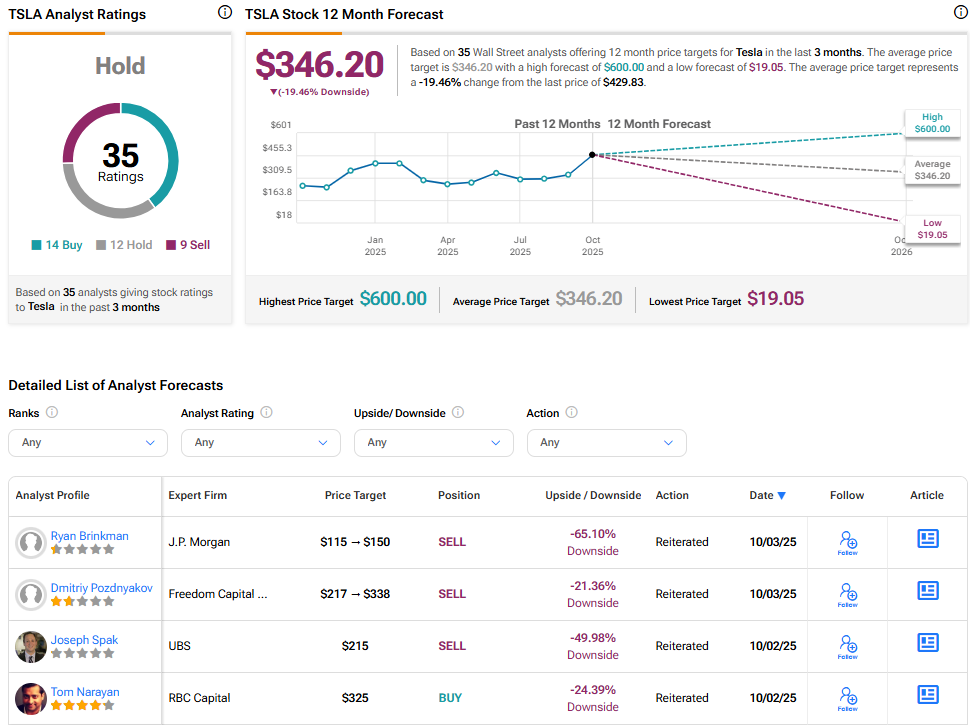

First, UBS analyst Joseph Spak kept a Sell rating and set a $215 price target. The analyst stated that Tesla’s sales in Europe are down by about 50% and that the end of the $7,500 U.S. tax credit may negatively impact demand in the coming months. UBS added that investors might take profits now that the support from those credits is gone.

On the other hand, J.P. Morgan’s analyst Ryan Brinkman raised his price target from $115 to $150 but kept an Underweight rating, which is the equivalent of a Sell. The analyst claimed that Tesla’s third-quarter deliveries of 497,000 cars were about 12% higher than forecasts, but it also called the surge a “temporary pull-forward” before the credits ended. J.P. Morgan now expects Tesla to post quarterly earnings per share of $0.59, which is still down 18% from a year earlier.

The third Sell rating came from Freedom Capital Markets’ analyst Dmitriy Pozdnyakov, with a target of $338. Analyst Dmitriy Pozdnyakov said Tesla’s U.S. growth may slow while international sales are already soft. He believes the company’s next few quarters will reveal how much of its recent strength was driven by short-term demand.

Even with the delivery beat, analysts are signaling caution. They see the next few quarters as a test for Tesla’s pricing power and for its ability to keep sales steady without policy support.

Is Tesla a Buy, Sell, or Hold?

The sentiment over Tesla is divisive among the Street’s analysts, with a Hold consensus rating. The average TSLA stock price target is $346.20, implying a 19.46% downside from the current price.