With the government up and running until at least mid-November, the Federal Trade Commission (FTC) lawsuits can go ahead unhindered. And that means Amazon (NASDAQ:AMZN) is right back on ground zero. However, new reports note that analysts don’t have too much trouble with Amazon getting sued by the FTC. Based on the modest upswing in its share price today, Amazon’s investors aren’t quibbling much either.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest issue comes around reports that Amazon may have turned to an algorithm to determine prices on its site. The algorithm, known as Project Nessie, reportedly allowed Amazon to establish prices in a fashion that would make sure competitors wouldn’t press the issue and ultimately undersell Amazon. Whether or not that was the case is unclear, but analysts don’t seem to have much problem with it. In fact, several analysts have maintained their position. Douglas Anmuth with JPMorgan notes that the FTC’s ability to prove that Amazon is using monopoly power to keep competitors out and inflate prices will be remarkably limited.

Is Amazon a Good Stock to Hold Forever?

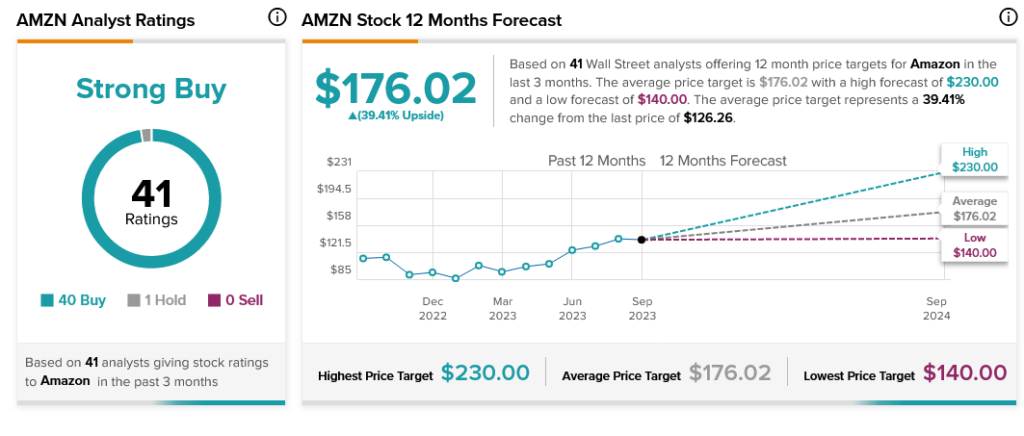

Regardless, it’s clear Amazon analysts are sticking around for the long haul. With 40 Buy ratings and one Hold, Amazon stock is a consensus-rated Strong Buy. Further, Amazon stock offers investors 39.41% upside potential thanks to an average price target of $176.02.