Remember when used car lots looked like they weren’t selling cars so much as they were selling available parking places? That’s because it was tough to actually get a car from the factory to the dealership. Now, there are signs that things are turning around, and getting cars to the dealerships is easier than it’s been in a long time. However, that may be turning around too much, and carmaker stocks are starting to take the hit as a result.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

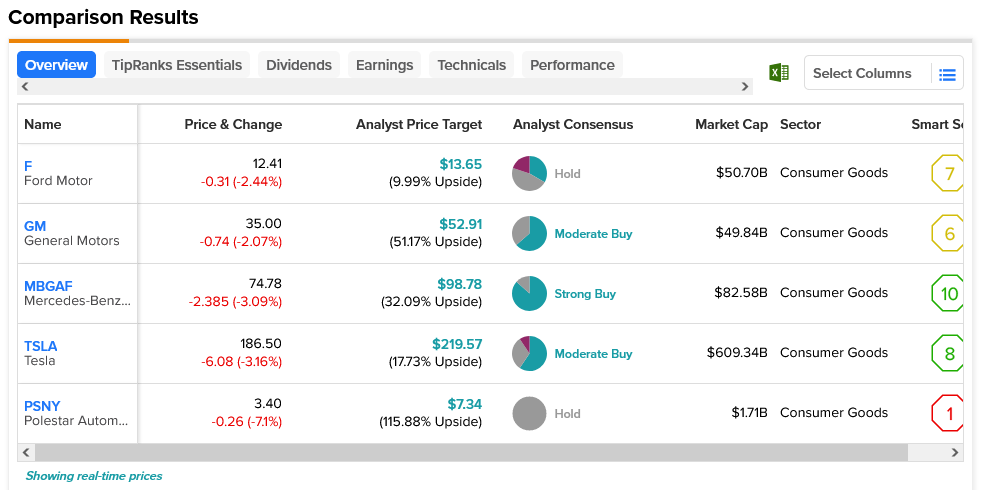

Several automakers across the entire spectrum were down in Wednesday afternoon’s trading. Legacy automakers Ford (NYSE:F) and General Motors (NYSE:GM) slipped 2.44% and 2.07%, respectively. Luxury automakers like Mercedes-Benz Group (OTC:MBGAF) also took a hit, down around 3.09%. Electric car makers weren’t immune here either, as Tesla (NASDAQ:TSLA) is down 3.16%, and Polestar Automotive (NASDAQ:PSNY) is down a whopping 7.1%.

UBS’ Patrick Hummel offered the perspective on the automobile industry, saying that the cries of “pent-up demand” just aren’t supported by the larger economic picture. Companies are still producing like demand is brisk, but the sheer number of cars on the lot suggests demand is waning. Already, GM cars are approaching luxury-pricing territories, and Tesla has been rapidly producing more cars than it can sell, according to a CNN report.

While all five of the listed stocks were down in trading today, there are still potential winners. Polestar, for example, may only be a Hold in analyst consensus, but its $7.34 average price target gives it a staggering 115.88% upside potential. Meanwhile, Ford—also a Hold—only offers a 9.99% upside potential with a $13.65 average price target.