While Papa John’s (NASDAQ:PZZA) has had its share of reversals and controversy over the years, it’s still a mainstay in the take-out pizza market. New word from Stifel, meanwhile, is putting a little extra wind in its sails as investors look hopeful, sending shares up modestly in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Stifel offered up some research, attributed to no single analyst, that gave a look at Papa John’s last few months and where it could be going to reach success. Stifel offered high praise for Papa’s improved ad spend, as well as its overall position. However, its praise for Papa was limited, noting that the improved ad presence isn’t likely to “meaningfully” improve sales unless more of that advertising starts focusing on sheer value. However, Stifel did offer some of the best praise, upgrading PZZA stock from Sell to Hold.

A Marketing Blitz

Papa’s marketing hasn’t exactly been value-focused but is instead going the quality route for the most part. It recently released an edible scented candle for National Garlic Day that, well, didn’t smell like roses. No, it was garlic-scented. Though, to be honest, there are much worse smells, and the theme certainly was on point.

Meanwhile, Papa John’s put on a full-court press with its branding, pivoting from the classic “Better Ingredients, Better Pizza” to “Better Get You Some,” turning to a new partnership with Outkast rapper Big Boi. Admittedly, with a line like “Gimme that ooey, gooey, crispy, crunchy, mouthwatering [Papa John’s],” there certainly is an appeal there. Maybe not the appeal some analysts might have preferred, but if you’re not feeling a little hungry from that line, you may have just eaten.

Is Papa John’s a Good Stock to Buy?

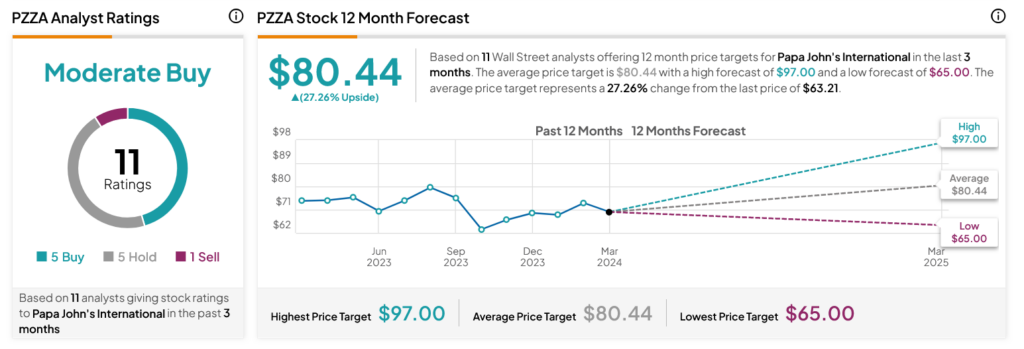

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PZZA stock based on five Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 13.14% loss in its share price over the past year, the average PZZA price target of $80.44 per share implies 27.26% upside potential.

Is It Wise to Allocate $1,000 Toward PZZA Stock Right Now?

Before you hurry to invest in PZZA, think about the following:

TipRanks’ team has built the Top Stocks Portfolio for investors, and Papa John’s is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant gains in the years ahead.

See The Stocks >>