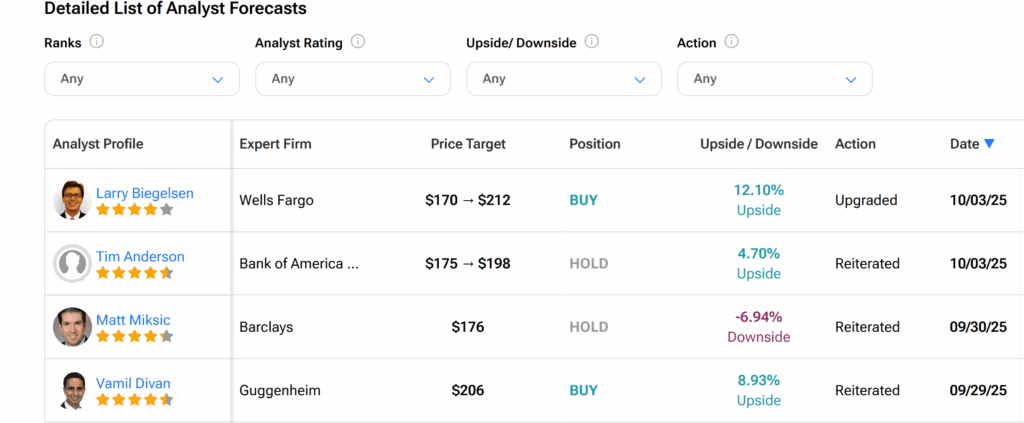

The shares of pharmaceutical giant Johnson & Johnson (JNJ) rose on Friday afternoon after the stock earned new price boosts from U.S. banking titans Wells Fargo (WFC) and Bank of America (BofA) (BAC). The former raised its price target for JNJ stock by 24.7% to $212 per share, while the latter upgraded it by 13% to $198.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wells Fargo analyst Larry Biegelsen raised the price target from $170, as his calculation based on Johnson & Johnson’s expected earnings over the next twelve months shows that JNJ stock is trading at a 30% discount compared to the benchmark index, the S&P 500. This view has also been propounded by some other analysts.

Biegelsen also pointed to the recent discount arrangement between rival Pfizer (PFE) and President Donald Trump as an indication that U.S. government tariff pressure may soften. The move may also lead to a less aggressive drug pricing environment, which could be beneficial for Johnson & Johnson. Moreover, other pharmaceuticals are expected to be onboarded for a similar arrangement.

Investors Unshaken by Stelara Exclusive Right Loss?

Furthermore, the Wells Fargo analyst pointed to shareholders’ confidence in the company’s ability to navigate headwinds posed by the expiration of the company’s exclusive production rights on its flagship anti-inflammatory injection, Stelara. He also pointed out that the New Jersey-based company has set aside approximately $55 billion to expand its domestic manufacturing, as well as research and development, over the next four years.

This adds to its $2 billion commitment to expand drug production in North Carolina. The Trump administration has emphasized that pharma companies that invest in local production will enjoy tariff exemptions.

Trump-Pfizer Deal ‘Pretty Benign Overall’

Furthermore, Biegelsen expects Johnson & Johnson’s revenue to expand by $3 billion more in 2027 than the current forecast estimate. The analyst also estimates the company’s earnings per share could be 17.5 times higher by 2027. He, therefore, upgraded the stock to an Overweight rating, seeing these factors as an “attractive entry point” for the stock.

On the other hand, BofA maintained its Neutral rating on JNJ stock, as its analyst, Tim Anderson, believes that Trump’s deal with Pfizer was “pretty benign overall.” He explained that while the timing of the arrangement was unexpected, its substance was not disruptive.

Is JNJ a Good Stock to Buy Now?

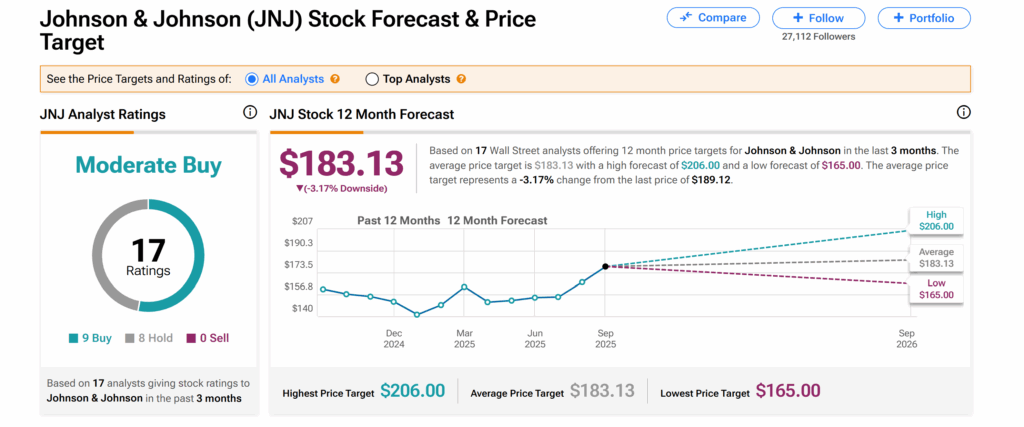

Meanwhile, across Wall Street, Johnson & Johnson’s shares currently have a Moderate Buy consensus recommendation, as TipRanks data shows. This is based on nine Buys and eight Holds assigned by 17 Wall Street analysts over the past three months.

However, the average JNJ price target of $183.13 suggests a 3% downside risk.