Recently, chip stock Intel (NASDAQ:INTC) pulled off a real win. It landed a $3.2 billion grant toward a new $25 billion chip plant in Israel. Yet, Intel slipped fractionally in Thursday afternoon’s trading as the value of its win wears off even while analysts are over the moon about it.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Some of the latest praise for Intel came from Argus Research, by way of analyst Jim Kelleher. Kelleher noted that 2023 wasn’t exactly a great year for Intel, which most observers were already figuring was the case. However, Kelleher was looking for a turnaround, starting with the fourth quarter, that should show improvements in the various year-over-year comparisons coming up. In fact, Kelleher not only maintained his Buy rating on Intel stock, but also hiked the price target substantially, going from $42 to $60, thanks to a set of new processors coming out soon from Intel that should draw plenty of interest, even given the macroeconomic environment we’re all seeing right now. And the Israel plant will likely also prove a help in keeping Intel at the front of chip development.

Some Chips are Already Making an Impact

A recent review in Forbes took a look at one of Intel’s latest chips, the Core i7-14700K. Tested on several games, it wasn’t top of the heap. In fact, it often lost to other Intel chips and some in the AMD (NASDAQ:AMD) Ryzen class. But it did deliver solid overall performance on a variety of games, which might well make it worthwhile for PC gamers looking for a chip package that won’t break the bank. Content creators might also find a friend in Intel, as several Intel Core models made the top five of Forbes’ list.

Is Intel a Buy, Sell, or Hold?

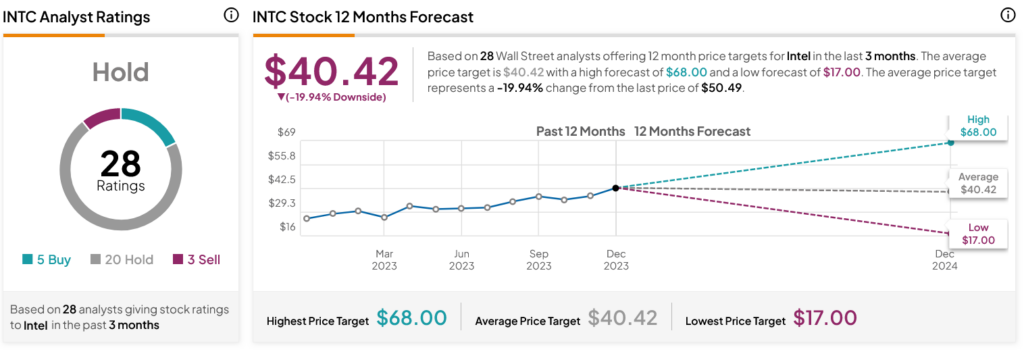

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on five Buys, 20 Holds and three Sells assigned in the past three months, as indicated by the graphic below. After a 97.52% rally in its share price over the past year, the average INTC price target of $40.42 per share implies 19.94% downside risk.