Micron Technology (NASDAQ: MU) is less likely to be impacted by China’s cybersecurity review, according to top Citigroup analyst Christopher Danely. Late last month, cybersecurity officials from the Cyberspace Administration of China began a review of some of the chipmaker’s products among issues with information infrastructure and hidden security risks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The analyst stated that while China comprised 15% of Micron’s total sales, the company’s fundamentals are driven more by the dynamic random access memory (DRAM) cycle. The analyst added, “We continue to expect more actions like this from both sides and their allies as the US seeks to slow China’s industrial espionage and China retaliates.”

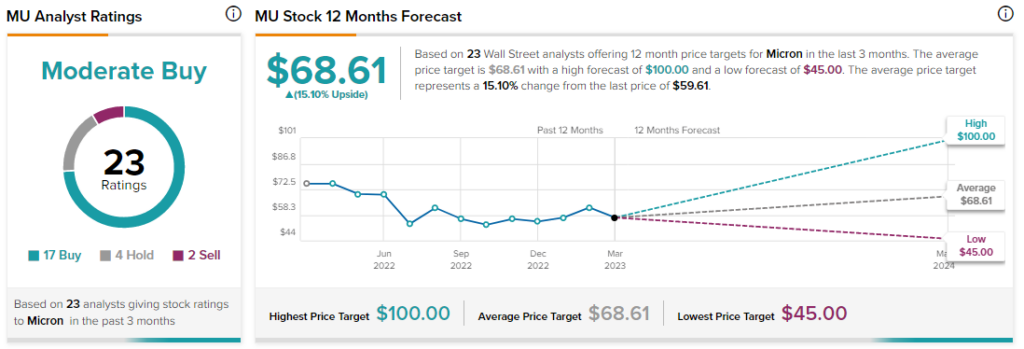

Danely reiterated a Buy rating and a price target of $75 on the stock, implying an upside potential of 25.8% at current levels.

Besides Danely, other analysts remain cautiously optimistic about MU stock with a Moderate Buy consensus rating based on 17 Buys, four Holds, and two Sells.