There’s been some doubt lately when it comes to corporate cloud spending. Some believe it’s the key to the future thanks to the number of applications involved. Others think it will be first on the chopping block when companies cut costs. For Bank of America (NYSE:BAC), however, it’s expecting bigger things out of the cloud, and some companies stand to do quite well.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

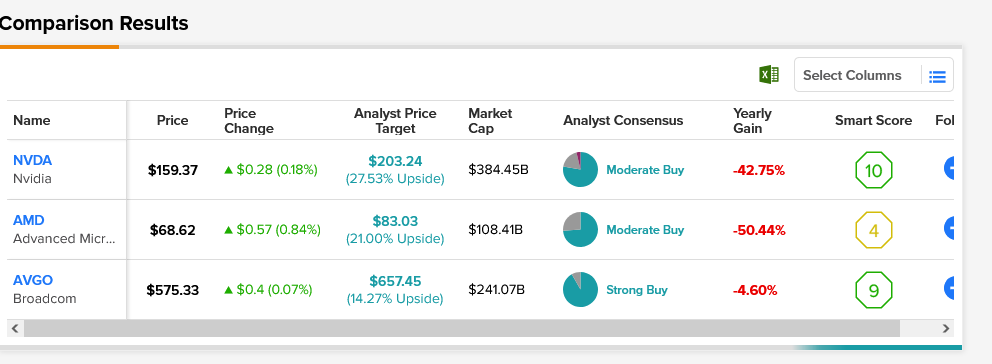

Bank of America, via analyst Vivek Arya, released word that the Buy recommendations currently on AMD (NASDAQ:AMD), Broadcom (NASDAQ:AVGO), and Nvidia (NASDAQ:NVDA) are remaining. Why? Because, as Arya’s report noted, there is some significant cloud spending about to kick in. Companies ranging from Amazon (NASDAQ:AMZN) to Google (NASDAQ:GOOGL) to Meta Platforms (NASDAQ:META) are all looking to further invest in the cloud. In fact, Arya’s report looks for extra spending to the tune of $44.3 billion in the fourth quarter alone.

However, Arya points out that cloud spending can be “volatile in nature,” which makes exact and accurate predictions a bit tougher to pin down. Indeed, there are several signs ahead that may pose trouble for the firms in question. Nvidia, for example, is having trouble getting gamers to the table for its new graphics card. The RTX 4070Ti is getting slaughtered by YouTube reviewers and commentators, with one going so far as to call the card a “ripoff.”

Analysts for the three companies have a mixed bag to offer, but everyone’s looking up to at least some degree. Broadcom leads the way right now as a Strong Buy, while both Nvidia and AMD stand at Moderate Buys. Broadcom stock also offers the least upside potential at 14.27%. Meanwhile, Nvidia stock offers the most upside, with an average price target of $203.24.