DocuSign (NASDAQ:DOCU), an electronic document signature stock, gained just under 2% in Wednesday afternoon’s trading after a new bit of analyst commentary hit shares. Apparently, things are looking brighter for electronic document signature companies than one might expect, and analysts are starting to come around to this point.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

DocuSign got a leg up from HSBC, where analyst Stephen Bersey hiked his rating from Sell to Hold and maintained his price target of $42 per share. Bersey went on to note “…signs of improvement in demand and stability” at DocuSign, as well as “stabilizing revenue.” Bersey acknowledged that the end of COVID-19 meant a crimp in DocuSign’s winning streak. But rather than being just one more former “pandemic darling” that couldn’t keep up, DocuSign was instead making a comeback and working to stabilize operations to “pre-COVID-19 levels.”

Indeed, recent word from Infinity Business Insights underscores this point well. A new report about the state of the “cloud e-signature tools market” revealed that the market was expected to be worth $10.27 billion by 2030. That’s a compound annual growth rate (CAGR) of 28.1% over the next seven years. With DocuSign regarded as one of the top figures in that market, that means a substantial part of that market is DocuSign’s to take.

Is DocuSign a Good Long-Term Investment?

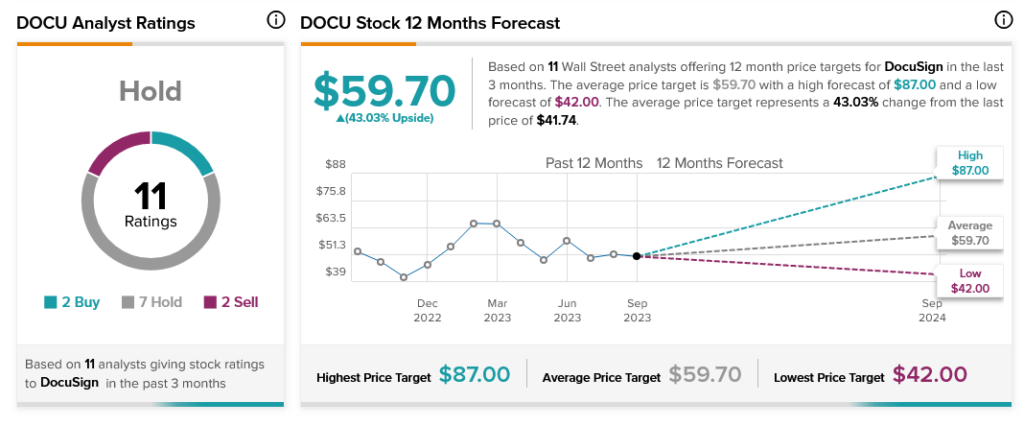

Yet despite this, many analysts are holding off on DocuSign. With two Buy ratings, two Sells, and seven Holds, DocuSign is consensus-rated as a Hold. However, those who buy in anyway will get access to an upside potential of 43.03% thanks to DocuSign’s average price target of $59.70.