Analog Devices’ (NASDAQ:ADI) board of directors has approved a 13% hike in its quarterly common stock dividend to $0.86, up from the $0.76 distributed previously. This marks the company’s 20th consecutive annual dividend increase. The increased dividend will be payable on March 8, to shareholders of record as of the close of business on February 27.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The multinational semiconductor company specializes in data conversion, signal processing, and power management technology.

Analog Devices CEO Vincent Roche said that the company continues to deliver strong performance. The company has been generating positive free cash flow for the past 26 years.

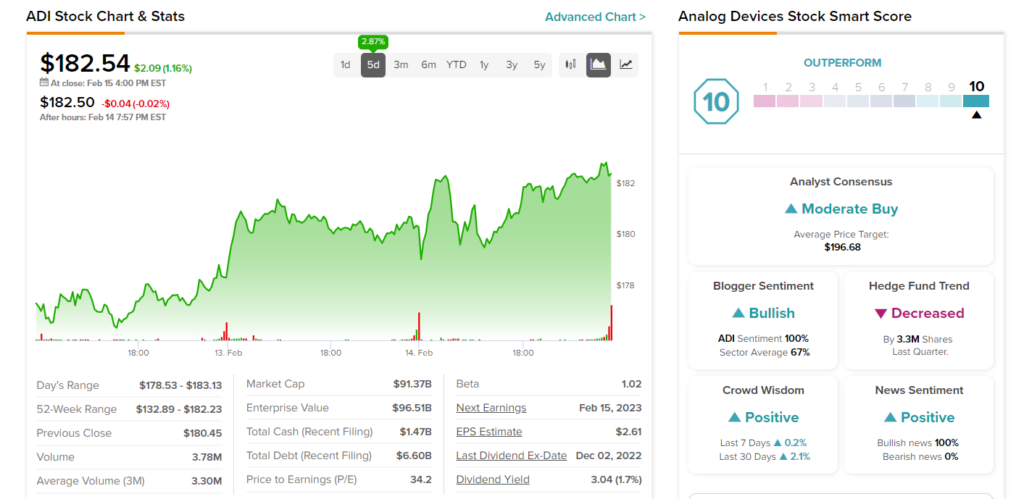

It is worth highlighting that the dividend announcement comes ahead of the company’s first quarter Fiscal Year 2023 results, expected to be released on February 15. The Street expects Analog Devices to report earnings of $2.61, up 34.5% from last year’s figure.

Is ADI a Good Stock to Buy?

Wall Street analysts are cautiously optimistic about ADI stock. On TipRanks, Analog Devices has a Moderate Buy consensus rating based on 14 Buys and five Holds ratings. The average stock price target of $196.68 implies 7.8% upside potential from current levels. Meanwhile, ADI stock has gained 12.4% since the start of 2023.

Furthermore, bloggers and retail investors are bullish on the stock. Overall, ADI scores a “Perfect 10” on TipRanks’ Smart Score rating system, pointing to its potential to outperform.