As if Boeing (NYSE:BA) didn’t have enough troubles already, along comes the most explosive problem seen yet. And in this case, “explosive” is literal. That was about the last thing that investors needed or wanted to hear right now, and Boeing shares were down nearly 7% in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

So, what’s the problem this time? As it turns out, the Federal Aviation Administration (FAA) revealed that Boeing’s 777 has a problem with electrical insulation near its fuel tanks. And, if that problem isn’t quickly addressed, then there’s every possibility that the electrical system could ignite the fuel, either causing a fire or an outright explosion.

The insulation fault in question is connected to around 300 Boeing jets currently in operation, including the 77-200, 77-200LR, 77-300, 77-300ER, and 777F lines. The closest thing to good news about this is that Boeing itself would not be responsible for the changes in question. That would fall to the airlines and operators of said aircraft.

Burning Cash as Fast as Fuel

Meanwhile, Boeing’s CFO, Brian West, came out with a little more disaster for Boeing shareholders – its cash burn rate was set to climb. This comes as it continues to slowly produce aircraft in accordance with federal requirements and its own new safety initiatives. Indeed, West noted, delivery rates aren’t likely to improve in the second quarter against the first.

But West offered a little hope for the future, suggesting that Boeing would stop burning through cash again and start generating it instead during the second half of 2024. With first-quarter deliveries already at their lowest since the pandemic, any improvement wouldn’t be exactly hard to achieve and would certainly be welcomed by investors.

Is Boeing a Buy or Sell Stock?

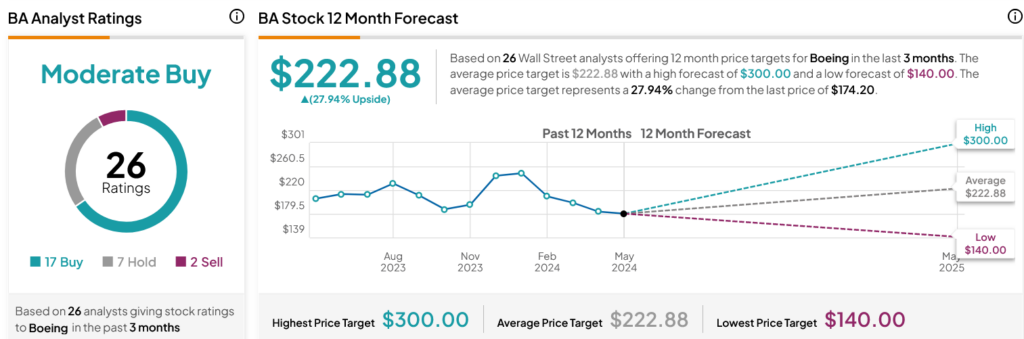

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 17 Buys, seven Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 12.78% loss in its share price over the past year, the average BA price target of $222.88 per share implies 27.94% upside potential.

Is It Wise to Allocate $1,000 Toward BA Stock Right Now?

Before you hurry to invest in BA, think about the following:

TipRanks’ team has built the Top Stocks Portfolio for investors, and Boeing is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant gains in the years ahead.

Discover Top Picks ➜