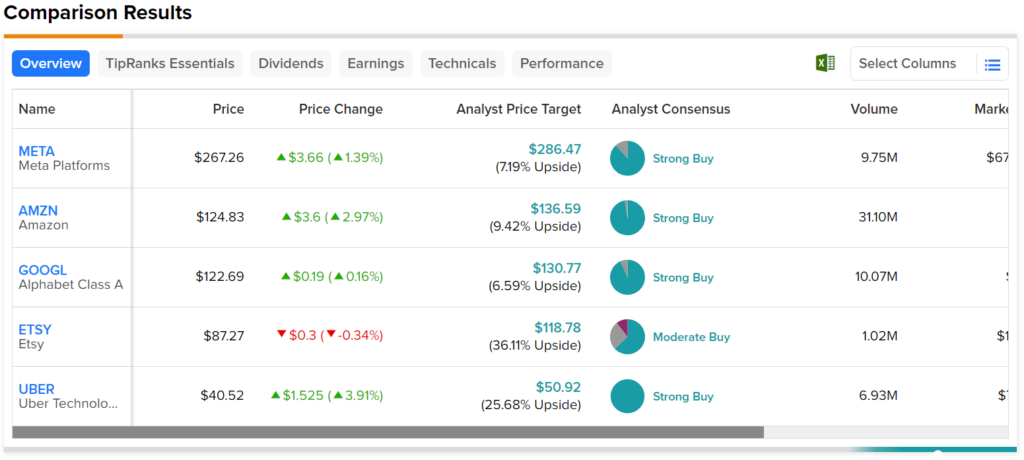

Wells Fargo recently launched its coverage of the large-cap internet sector, presenting a buy-equivalent rating to only two stocks. Analyst Ken Gawrelski stamped Amazon (NASDAQ:AMZN) with an Overweight rating and a price target of $159 per share, labeling it the Top Pick. He predicts that North American retail margins will revert to 2019 levels by 2025, with Amazon Web Services (AWS) likely to see a positive growth shift by August, ultimately exiting the year with 15% growth in December.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The other Overweight rating was accorded to Uber (NYSE:UBER), with a $50 price target. Gawrelski perceives that further retrenchment by international competitors due to regulatory issues or a gloomy private company funding environment will favor Uber.

Gawrelski issued ratings for 11 other stocks as well, with four being Underweight and seven as Equal Weight. A notable underweight rating was Etsy (NASDAQ:ETSY), which was given a $70 price target due to an impending “growth-challenged” phase. Gawrelski noted that Etsy’s customer acquisition efficiency metrics are showing signs of wear following years of rampant GMS growth and take-rate expansion.

Among the noteworthy Equal Weights, Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) was started with a $117 price target, with Gawrelski pointing out an AI transition in the search format that may drive headwinds to medium-term search growth. Meta Platforms (NASDAQ:META) was rated Equal Weight with a price target of $276, with optimism around advertising acceleration and Advantage+ adoption potentially curtailed by diminishing returns on Advantage+ campaigns and muted ad buyer optimism around Reels medium-term monetization.

Interestingly, of the mentioned internet stocks, ETSY has the highest upside potential at over 36% despite receiving a downgrade from Wells Fargo. Conversely, GOOGL has the lowest upside potential at just 6.59%.