Shares of Amazon (NASDAQ:AMZN) gained today after Loop Capital—via analyst Rob Sanderson—suggested that the rise of generative AI will help fuel demand for AWS, leading to revenue growth reacceleration by the end of the year. Back around August 2022, Sanderson notes, most AWS customers were starting processes focused on “cost optimization,” which meant cutbacks on things like AWS operations. But now, that’s nearly concluded, and that should open up the potential for new growth.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In addition, AWS is sinking $100 million into a fresh initiative, the AWS Generative AI Innovation Center, aimed at helping customers develop and implement generative AI solutions. The program will foster collaboration between AWS’s AI and machine learning gurus and clients in an effort to kickstart new AI-driven products, services, and procedures. Companies like Highspot, Lonely Planet, Ryanair (NASDAQ:RYAAY), and Twilio (NYSE:TWLO) are already exploring the potential of generative AI solutions through this innovation hub.

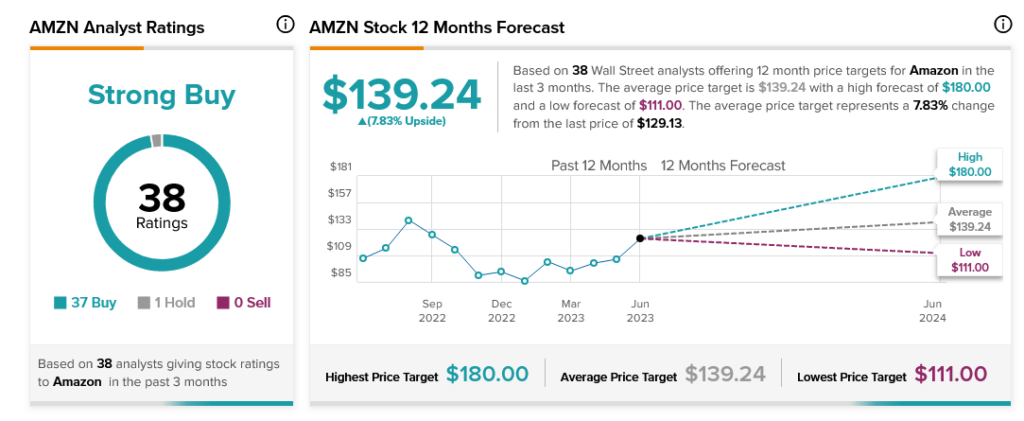

Amazon itself, meanwhile, enjoys no shortage of analyst support. With 37 Buy ratings to just one Hold, Amazon stock is considered a Strong Buy by analyst consensus. Furthermore, with an average price target of $139.24, Amazon stock offers its investors 7.83% upside potential.