Amazon’s stock (NASDAQ:AMZN) is down today after the company reported slowing revenue growth for its Amazon Web Services (AWS) division. Despite a strong first quarter, investors worried that AWS might be losing ground to rivals like Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL). However, analysts from Benchmark Research and UBS believe it’s too soon in Q2 to spot a trend, and the dip in AWS revenue growth may not signal a specific issue.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Addressing Amazon’s caution about AWS customers optimizing cloud spending due to economic conditions, Morgan Stanley analysts point out that the AWS optimization process is more than halfway done. They emphasize that Amazon should concentrate on the long-term, focusing on AWS’ ability to tap into the $2.5 trillion public cloud market. Both Evercore ISI and Bank of America analysts remain optimistic about Amazon’s retail performance and the possibility of increased margins, stressing that the company’s long-term prospects are still solid.

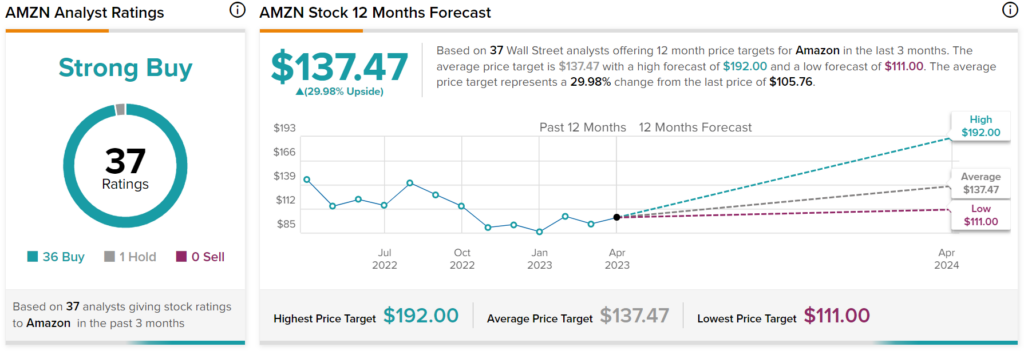

Overall, Wall Street analysts have a consensus price target of $137.47 on AMZN stock, implying almost 30% upside potential, as indicated by the graphic above.