The Alliance of Motion Picture and Television Producers (AMPTP) noted yesterday, October 11, that negotiations related to labor contract renewal with striking actors have been suspended for the time being. The Screen Actors Guild – American Federation of Television and Radio Artists (SAG-AFTRA) presented a new proposal on Wednesday that was disregarded by the Hollywood Studios consortium. The AMPTP, which represents media companies like Walt Disney (NYSE:DIS), Netflix (NASDAQ:NFLX), and Paramount Global (NYSE:PARA), said the proposal included roughly $800 million in viewership bonuses annually that “would create an untenable economic burden” on the studios.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In their latest offer, the AMPTP agreed to pay $717 million in additional wages and $177 million towards pension and health plans, coupled with a spike in international streaming royalties. However, striking actors are unhappy with the increment and remain stuck on the viewership bonus issue. The studios’ coalition contended that the offer was similar to the ones ratified by the Directors Guild and Writers Guild, and they can not bear any further expenses.

The pause in negotiations means that actors and artists are not returning to work anytime soon. This hampers the industry’s planning and scheduling for the 2023-2024 season. Television shows and movie releases will suffer a major setback if the strike continues beyond October and into the holiday season.

Media Companies Hit by the Actors’ Strike

The SAG-AFTRA is the biggest actors’ union in the U.S., representing 160,000 artists. The union went on strike on July 14, following the Writers Guild of America’s (WGA) strike in May. Meanwhile, the AMPTP represents some of the largest names in entertainment, including Walt Disney, Netflix, Amazon (NASDAQ:AMZN), Paramount Global, Comcast (NASDAQ:CMCSA), Warner Bros. Discovery (NASDAQ:WBD) and Sony (NYSE:SONY).

It is worth noting that the Writers Guild of America (WGA) ratified a new three-year contract with Hollywood Studios on October 9 after five months of strike. As per the Guild, 99% of the WGA members voted unanimously in favor of the renewed Minimum Basic Agreement.

Media companies are bearing the brunt of the prolonged strikes. Plus, the increased wages across the board, including for writers, actors, and artists, will pinch a hole in their pockets. Regardless, the AMPTP hopes that the SAG reconsiders its decision and that the two parties can finalize a contract so that work can be resumed.

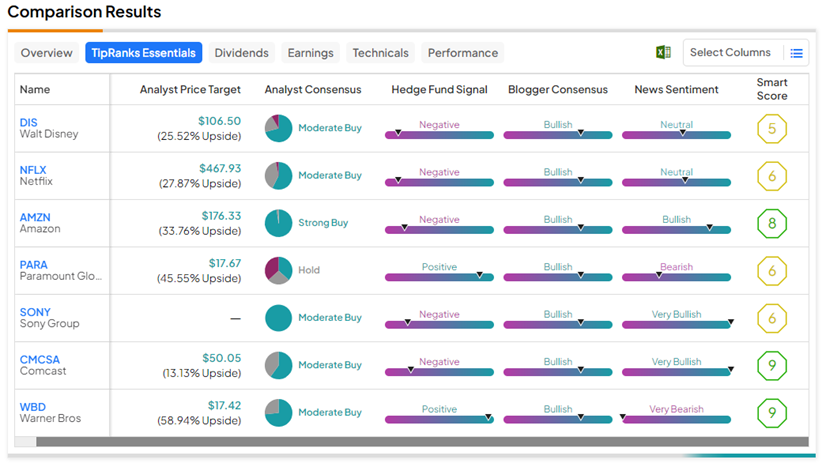

With this background in mind, let us see how each of these aforementioned stocks performs on the TipRanks Stock Comparison tool.

We can see that currently, only Amazon.com commands a Strong Buy consensus rating on TipRanks. That’s also because, in addition to its Prime Video offering, Amazon runs the largest online retail marketplace in the world and hosts a successful cloud service (Amazon Web Service). Meanwhile, WBD stock boasts a TipRanks’ Smart Score of nine and has the highest upside potential (58.9%), as indicated by its average target price.