As competition continues to heat up in the AI infrastructure space, cloud-based data storage platform Snowflake (SNOW) appears well-positioned to compete, even as it just received new price target boosts from two five-star Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wedbush analyst Daniel Ives believes that Snowflake is still in “the early innings of capitalizing on AI demand” and has “ample room to accelerate its growth”. Ives raised his price target on SNOW stock to $270 per share, which is up from $250. He also maintained his Outperform rating on the stock.

Analysts Defend Bullish Stance on Snowflake

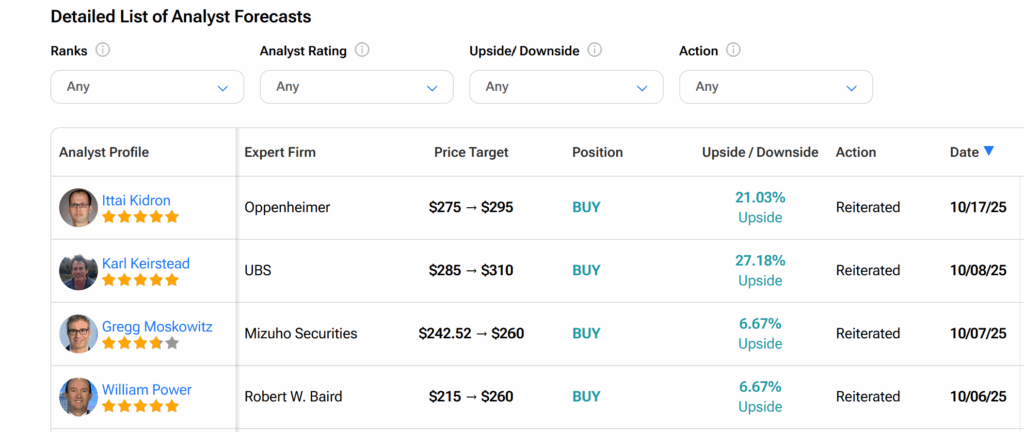

Meanwhile, Oppenheimer analyst Ittai Kidron went even further, boosting his price target by more than 68% from $175 to $295 per share. Kidron, who also stuck to his Outperform rating on SNOW stock, noted that his team expects Snowflake to report strong quarterly results in its third quarter results for fiscal year 2026 expected in late November.

In his defense, Ives noted that Snowflake can expand further by adopting newer engineering and marketing strategies to make it easier for its customers to use its platform for product adoption. He added that the company already enjoys great client patronage, with half of Snowflake’s new clients using its platform for AI-related tasks.

How’s Snowflake’s AI Offering Going?

Continuing, the Wedbush analyst pointed out that a quarter of Snowflake’s customers actively use its AI features every week. Ives believes that Snowflake continues to stand out among its competitors, even as Cortex, the company’s AI platform built into its data cloud technology, continues to provide high-quality data retrieval for client AI projects.

On his part, Kidron added that the equity research firm’s engagement with Snowflake’s sales and partner channels — which includes resellers, solution providers, and other stakeholders who help Snowflake sell its products — indicates a strong flow in Q3 deals, with a similar pattern already in gear in the ongoing quarter.

Both ratings come as Snowflake in recent days announced its new patnership with data analytics software provider Palantir Technogies (PLTR) for enterprise-ready AI and data analytics integration.

Is SNOW a Good Stock to Buy Now?

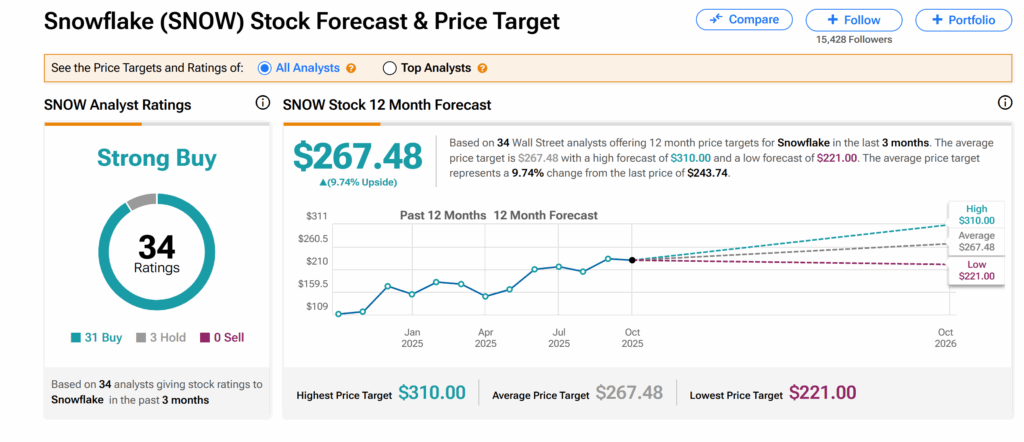

Across the broader Wall Street, Snowflake’s shares currently enjoy a Strong Buy consensus rating. This is based on 31 Buy and three Hold recommendations issued by analysts over the past three months.

Moreover, the average SNOW price target of $267.48 indicates about 10% growth possibility from the current level.