Amphenol Corp (APH) shares have been one of the year’s top gainers. The electrical connectors producer’s stock has climbed about 82% since the start of the year as demand for parts used in AI systems and data centers keeps rising.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

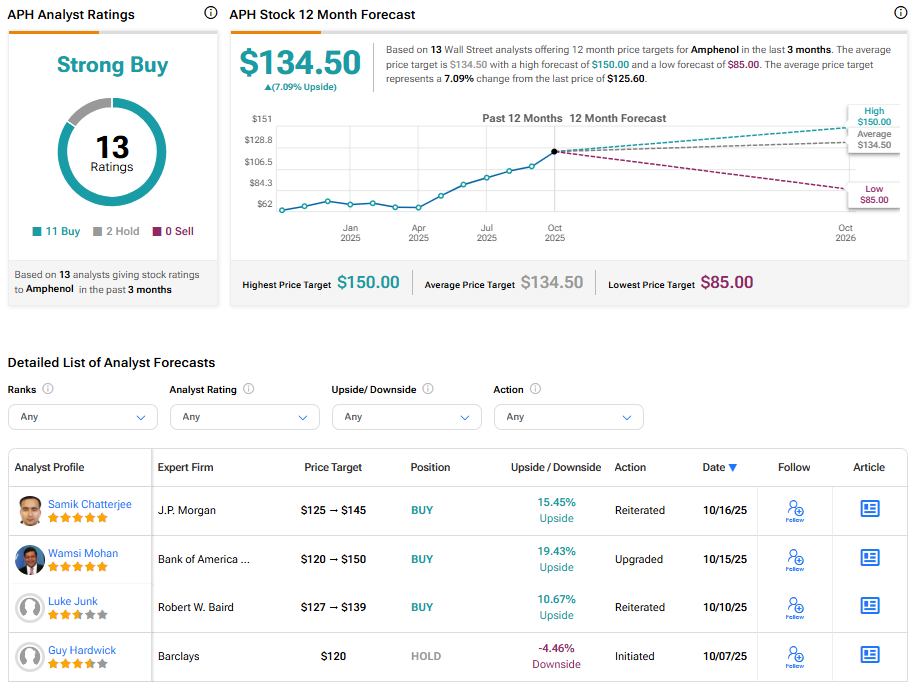

Yesterday, Bank of America raised its rating on Amphenol to Buy from Neutral and lifted its price target to $150 from $120. Five-star analyst Wamsi Mohan said the company could see stronger AI hardware demand and steady mergers and acquisitions activity. The new target points to a possible gain of about 22% from Tuesday’s close.

Today, J.P. Morgan’s five-star analyst Samik Chatterjee reiterated a Buy rating on the stock and set a price target range of $125 to $145. He cited Amphenol’s strong organic growth in the IT and Datacom sectors, which have become key revenue drivers. Chatterjee said that the rising need for AI infrastructure is fueling this strength, especially as hyperscalers and other tech firms expand their data center capacity. He also expects steady capital spending in cloud projects to support revenue growth.

In the meantime, APH shares rose 2.41% in yesterday’s trading, closing at $125.60.

Strong Position in AI Infrastructure

Amphenol makes electrical connectors, copper cables, and fiber cables used in data centers and chip systems made by companies like Nvidia (NVDA). Mohan expects triple-digit growth in Amphenol’s AI-related sales through 2026 as more companies expand their computing infrastructure.

He also pointed to several other reasons for his positive view. These include higher-than-expected AI rack volumes, stronger content in Nvidia’s next-generation systems, and a slower shift toward co-packaged optics, which should help Amphenol’s copper products stay in demand. The company’s recent purchase of CCS is also expected to expand its presence in fiber systems.

Broader Growth Beyond AI

Beyond AI, Amphenol continues to show consistent performance across other markets such as industrial and automotive. Both analysts note that the company’s balanced growth outside AI reflects strong execution and a steady pace of acquisitions.

Is APH a Good Stock to Buy?

Amphenol has the backing of the Street’s analysts with a Strong Buy consensus rating. The average APH stock price target stands at $134.50, implying a 7.09% upside from the current price.