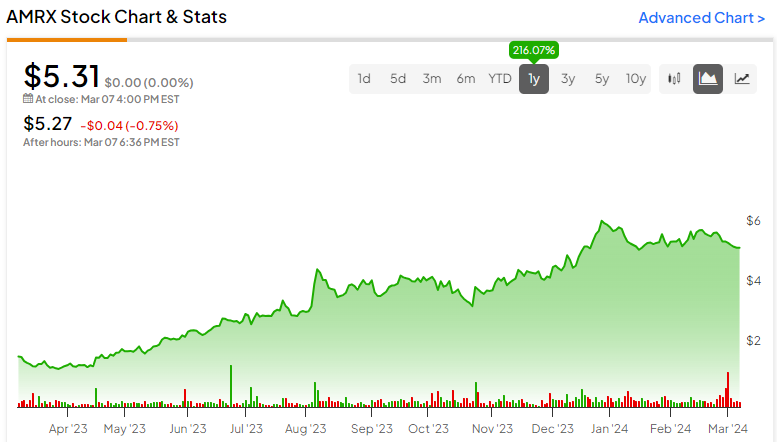

Amneal Pharmaceuticals (NASDAQ:AMRX) has established a compelling portfolio across specialty and generic pharmaceuticals and government services. The company has capitalized on the industry’s robust growth, hitting a net revenue of $2.39 billion in 2023 and projecting strong growth this year. The stock is up 216% over the past year, yet it appears to be relatively undervalued. The combination of strong earnings momentum and attractive valuation makes this stock a compelling option.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Specialty & Generic Pharmaceuticals

Amneal Pharmaceuticals, based in Bridgewater, New Jersey, develops, manufactures, and distributes a wide range of medical products.

The company operates a Generics division of pharmaceutical products, a Specialty segment (focused on innovative treatments like Rytary for Parkinson’s, Unithroid for hypothyroidism, and IPX203, a promising product in the pipeline for Parkinson’s), and the AvKARE segment (serving governmental agencies and departments distributing pharmaceuticals, medical and surgical products).

The specialty pharmacy sector, a key focus for Amneal Pharmaceuticals, has emerged as one of the most rapidly expanding segments in the industry, with a remarkable growth rate over the past decade. Currently contributing 40% of prescription revenue, this subsegment is projected to account for nearly 50% by 2027. McKinsey’s analysis further supports this trend, forecasting a steady annual growth rate of 8% through 2025.

Recent Financial Results

Amneal’s recent earnings report for Q4 2023 offered a mixed bag. Q4 revenue of $617 million missed consensus expectations of $634.23 million, while adjusted EPS of $0.14 beat analysts’ estimates of $0.09.

However, looking at the overall performance in Fiscal 2023, the company displayed strong growth and profitability across all business segments. The pharmaceutical manufacturer’s net revenue jumped to $2.39 billion, an 8% increase from the previous year.

Amneal anticipates a promising Fiscal 2024, forecasting net revenue in the range of $2.55 billion to $2.65 billion. This underpins its confidence in continuing strong growth despite the complexities and challenges of the pharmaceutical industry.

Where the Stock Stands

AMRX stock has been trending up over the past year. It trades towards the upper end of its 52-week range of $1.24-$6.30, though below the 20-day and 50-day moving averages of $5.54 and $5.45, respectively, demonstrating a possible break in price momentum.

However, from a valuation perspective, the stock looks undervalued. The P/S of 0.7x is well below the sector (Healthcare) and industry (Drug Manufacturers – Specialty & Generic) averages of 1.99x and 2.14x, respectively. AMRX’s EV/EBITDA of 8.76x is also lower than the industry average of 12.18x.

The combination of momentum and value could make this a compelling entry point for the stock.

What is the Price Target for AMRX?

Analysts covering the stock have been bullish. For example, Barclays analyst Balaji Prasad recently raised AMRX’s price target to $8 from $6. He kept an Overweight rating on the shares, citing a positive outlook on the industry and opportunities for Amneal’s product mix.

AMRX scores a Strong Buy based on four Buy ratings in the past three months. The average target is $6.75, reflecting 27.12% upside from current levels.

The Big Picture

Amneal Pharmaceuticals has the wind at its back with a broad portfolio of products in the industry’s fastest-growing segment. Despite a slight miss in Q4 revenues, the company has demonstrated strong earnings growth and projects the trend to continue into 2024. The stock appears poised for a possible upside, and its current valuation presents a potentially enticing entry point. Value investors looking for a pharma play, take notice.