Alphabet-owned (GOOGL) search engine giant Google has launched a new partnership program for its streaming platform YouTube. The program expands the company’s current support ecosystem for its YouTube ad business.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Google, the new program brings together a group of trusted third-party partners with expertise in ad buying strategies and campaign management. The goal is to help advertisers get the best results from their advertising projects on YouTube, which is the world’s streaming platform.

The companies already onboarded to the program include Channel Factory, MiQ digital, Pixability and Zefr. These service companies combine data analytics and AI to help brands optimize their advertising campaigns on YouTube.

Google Expands Partnership Ecosystem for YouTube

The new program expands on previous such networks launched by Google. For instance, YouTube BrandConnect was launched in 2020 and links brands with content creators for sponsored content on the streaming platform. The YouTube measurement program came earlier in 2018 and accredits third-party analytics providers.

Google also has the Google Marketing Platform Partners, where it verifies third-party companies to provide services such as video and search advertising. It also has the Advertising Technology Partners, which offers information on independent ad measurement partners, among others.

Google Faces AdTech Business Breakup Pressure

The launch comes at a time Alphabet is battling a hefty $3.45 billion fine from the European Commission over alleged anti-competitive practices in its online advertising technology business.

It marked the fourth antitrust penalty levied against the tech giant by EU regulators in the past decade, with this one including the possibility of being forced to break up its AdTech business. However, Google is reportedly working on possible changes to the business to avoid a full breakup.

Is Google a Buy, Hold, or Sell?

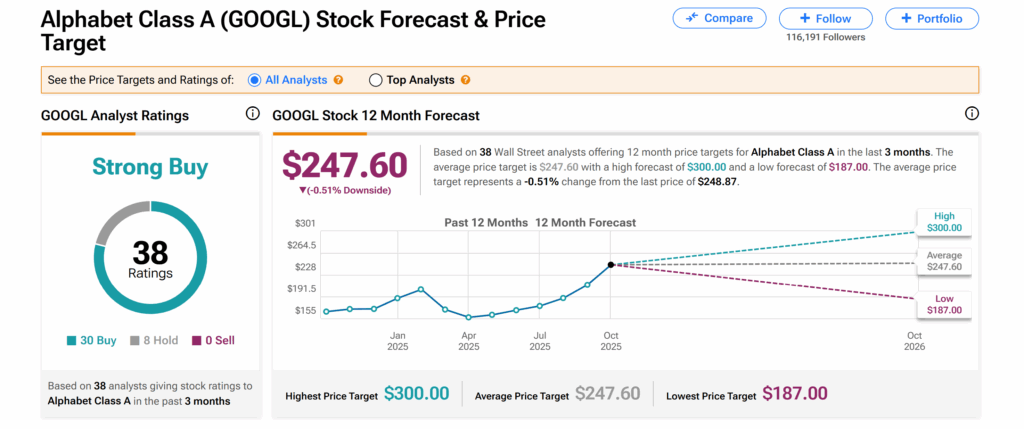

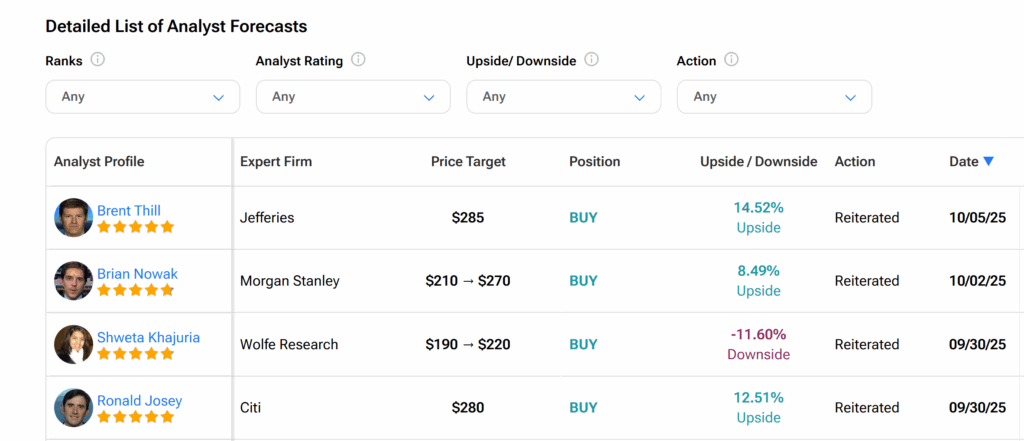

Turning to Wall Street, Alphabet’s shares currently boast a Strong Buy consensus recommendation, as seen on TipRanks. This is based on 30 Buys and eight Holds assigned by Wall Street analysts over the past three months. However, the average GOOGL price target of $247.60 indicates a 0.51% downside risk from the current level.