Biotechnology company Amgen (NASDAQ:AMGN) has agreed to acquire Ireland-based Horizon Therapeutics (HZNP) in a deal valued at about $27.8 billion. In what could be the largest-ever deal for Amgen, it has offered $116.5 per Horizon share, reflecting a premium of around 19.7% to Friday’s closing price of $97.29. HZNP stock jumped over 14% in Monday’s pre-market trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Amgen went ahead with the deal after French pharma company Sanofi (SNY) announced on Sunday that it no longer intends to make an offer for Horizon, saying the “transaction price expectations do not meet our value creation criteria.” Prior to Sanofi, Johnson & Johnson’s (JNJ) unit Janssen Global Services backed out of the deal earlier this month.

Horizon stock has rallied nearly 24% since November 29, the day the company announced that it was in preliminary discussions with Amgen, Janssen Global Services, and Sanofi for a potential acquisition. Horizon is focused on developing medicines that address rare, autoimmune, and severe inflammatory diseases. Horizon has a strong portfolio of drugs, especially its thyroid eye disease treatment Tepezza. It generated sales of $3.2 billion in 2021, reflecting a growth of 47%.

Meanwhile, Amgen is strengthening its portfolio through organic development and strategic acquisitions. In October 2022, Amgen acquired ChemoCentryx, a biopharmaceutical company focused on therapeutics to treat autoimmune diseases, inflammatory disorders, and cancer, for about $3.7 billion.

Is Amgen a Buy, Sell, or Hold?

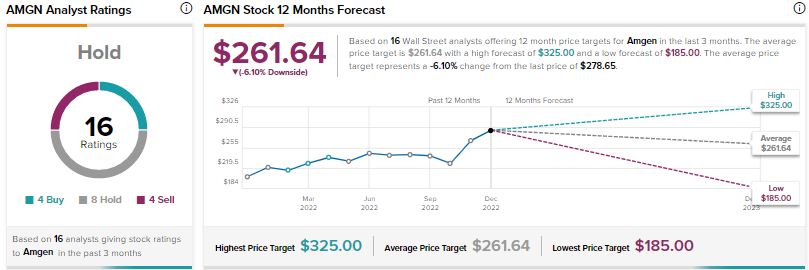

Wall Street is currently sidelined on Amgen stock, with a Hold consensus rating based on four Buys, eight Holds, and four Sells. The average AMGN stock price target of $261.64 implies a possible downside of 6.1% from current levels. Shares have rallied 24% year-to-date.