Integrated payments company American Express (NYSE: AXP) reported strong Q3 results, with its earnings surging by 34% year-over-year to $3.30 per share. This was above analysts’ consensus estimate of $2.95 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s revenues increased by 13% year-over-year to $15.4 billion, which was in line with analysts’ expectations. Management stated that overall card member spending remained strong and was up by 7% year-over-year on the basis of an adjusted currency exchange rate. The expenditure on travel and entertainment remained robust, up by 13% year-over-year on an FX-adjusted basis.

Stephen J. Squeri, Chairman and CEO, commented, ” Spending by these [millennial and Gen Z consumers] customers was up 18% in the U.S. from a year earlier, and they accounted for more than 60% of all new consumer account acquisitions globally.”

What is the Future of AXP Stock?

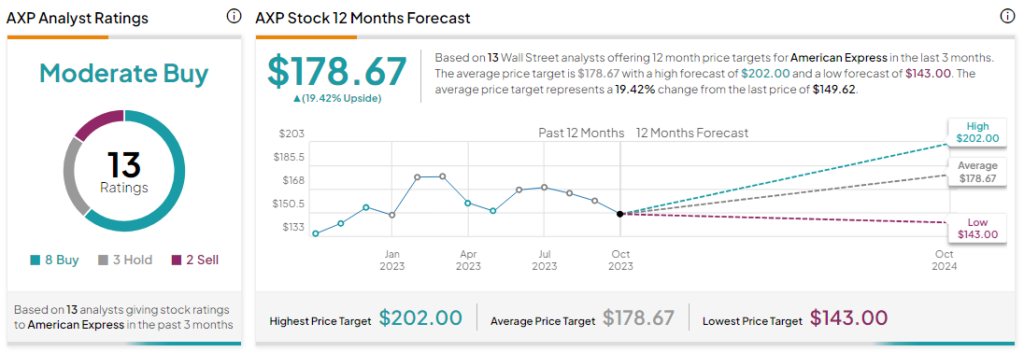

Analysts are cautiously optimistic about AXP stock, with a Moderate Buy consensus rating based on eight Buys, three Holds, and two Sells. The average AXP price target of $178.67 implies an upside potential of 19.4% from current levels.