Airline company American Airlines Group (NASDAQ: AAL) ticked higher in pre-market trading on Thursday after reporting Q3 results. The company posted adjusted earnings of $0.38 per share, which was above Street estimates of $0.25 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It also delivered record third-quarter revenues of $13.5 billion, in line with estimates. More importantly, AAL slashed its debt by $1.4 billion in the third quarter. The company stated that AAL is “more than 70% of the way to its goal” of slashing it total debt by $15 billion by the end of 2025. As of September 30, the company had reduced its total debt by around $10.9 billion from peak levels in mid-2021.

Looking forward, management stated that it expects its Q4 adjusted operating margin to be in the range of 2% to 4% and its FY23 adjusted operating margin to be around 7%.

What is the Price Target for AAL?

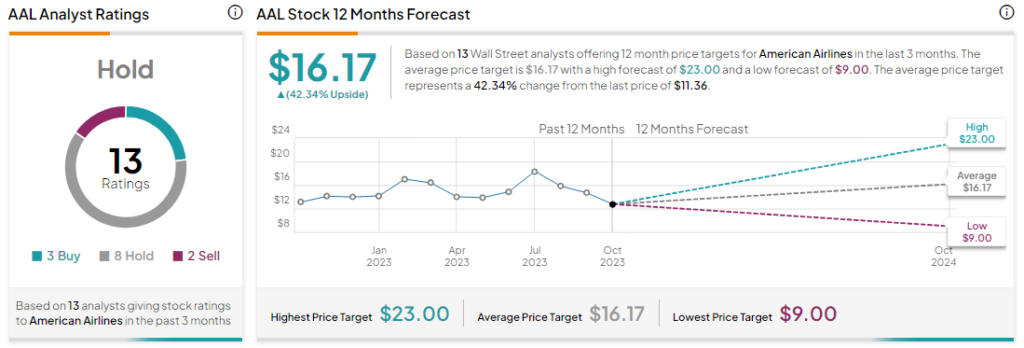

Analysts remain sidelined about AAL stock with a Hold consensus rating based on three Buys, eight Holds, and two Sells. The average AAL price target is $16.17 implies an upside potential of 42.3% from current levels.