Shares of air carrier American Airlines Group (NASDAQ:AAL) are in focus today after the company delivered a better-than-anticipated first-quarter bottom line.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue surged 37.1% year-over-year to $12.2 billion and was in line with estimates. EPS at $0.05 came in ahead of expectations by $0.01. Importantly, this was the first time the company tucked in a first-quarter profit in the past four years.

During the quarter, AAL operated over 476,000 flights at an average load factor of 80%. The company continues to see robust demand and managed to pare down debt by more than $850 million in Q1.

Looking ahead, for Q2 2023, AAL expects EPS to hover between $1.20 and $1.40. EPS for the full year 2023 is anticipated between $2.50 and $3.50.

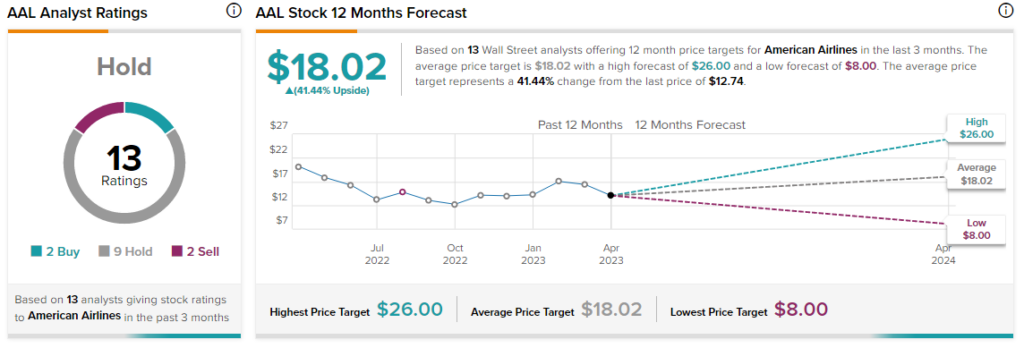

Overall, the Street has an $18.02 consensus price target on AAL, pointing to a hefty 41.4% potential upside in the stock. That’s after an 8% slide in the share price over the past month.

Read full Disclosure