Several insiders at Amerco (NASDAQ:UHAL) bought about 744,900 shares of the company in multiple transactions on December 7 and December 8 for about $48.4 million. Amerco engages in the provision of insurance, moving, and storage operation businesses.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

One of the insiders is Amerco’s president, chairman, and CEO Edward J. Shoen. He also holds more than 10% of UHAL stock. Shoen bought 248,300 shares at an average price of $64.96 per share, for a total transaction value of $16.13 million.

Further, shares were purchased by Mark V. Shoen, who is also a more than 10% owner of Amerco’s shares. At an average price per share of $64.95, he bought 248,300 shares for a total value of about $16.13 million.

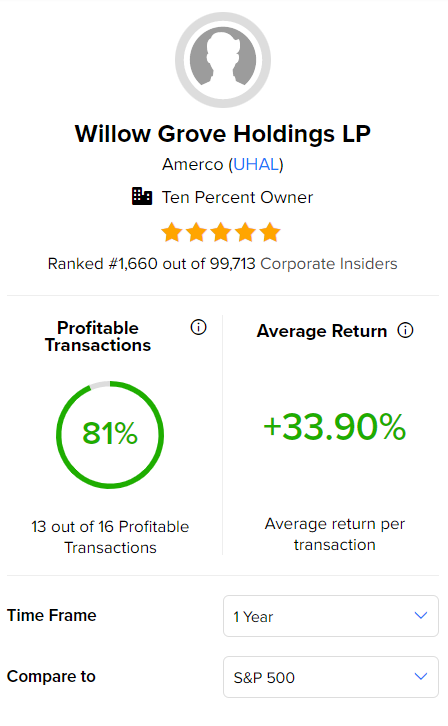

Lastly, Willow Grove Holdings LP, a more than 10% holder of Amerco’s shares, has purchased another 248,300 shares, for a total value of $16.13 million. According to an SEC filing, Willow Grove is owned and controlled by Foster Road LLC, along with various trusts associated with Edward J. Shoen and Mark V. Shoen.

Willow Grove has the highest success rate of 81% among the three insiders based on 16 transactions in the last year. Remarkably, the average return per share when compared with the S&P500 stands at an impressive 33.9%.

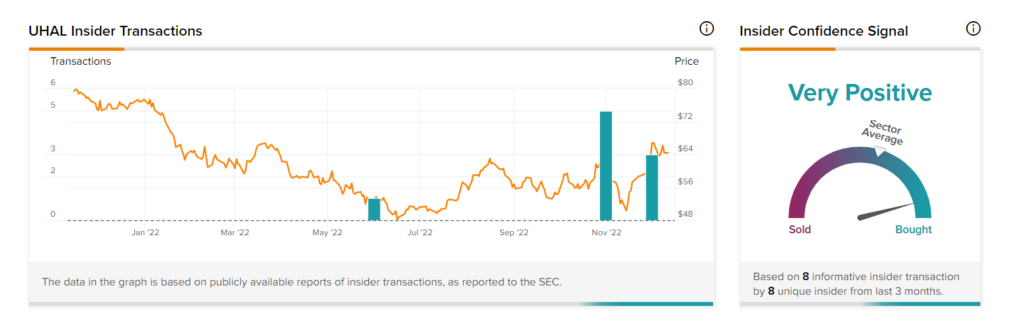

Overall, corporate insiders have bought UHAL shares worth $165.6 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in Amerco stock is currently Very Positive.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Recent Developments

Last month, Amerco underwent a 10-for-1 stock split. As a result, one UHAL share bought prior to November 10th, 2022, now equals 10 UHAL shares. The new shares are non-voting shares and are trading as Amerco Non-Voting Ordinary Shares Series N (UHALB).

Furthermore, the company disclosed that it will change its name to U-Haul Holding Company on December 19. Also, the listing of its voting common stock “UHAL” and non-voting common stock “UHALB” will be transferred to the NYSE from the Nasdaq on the same day.

Ending Note

While Insiders are bullish on UHAL, hedge funds have a neutral stance on the stock. Also, Amerco scores 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock is likely to outperform market expectations.