Chip stocks have had a rough go of it lately. Between the supply chain crunches that made every chip maker look like it was making gold to a potential recession that made chips a lot less in demand, it’s been ups and downs ever since. Now AMD (NASDAQ:AMD) is leading most of the chip sector higher thanks to a new connection between itself and Microsoft (NASDAQ:MSFT), adding over 5% at the time of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The move that gave AMD its leg up, and turned into a halo effect for most of the chipmaking field, was that AMD and Microsoft were part of a Bloomberg report that the pair were working together on chips for artificial intelligence applications. Microsoft was putting up a chunk of the cash required for such a feat, while AMD was partially financing it and partially handling the technical end. Further, AMD is also supplying some know-how while Microsoft works on its Athena chip, a chip designed to drive AI development as well.

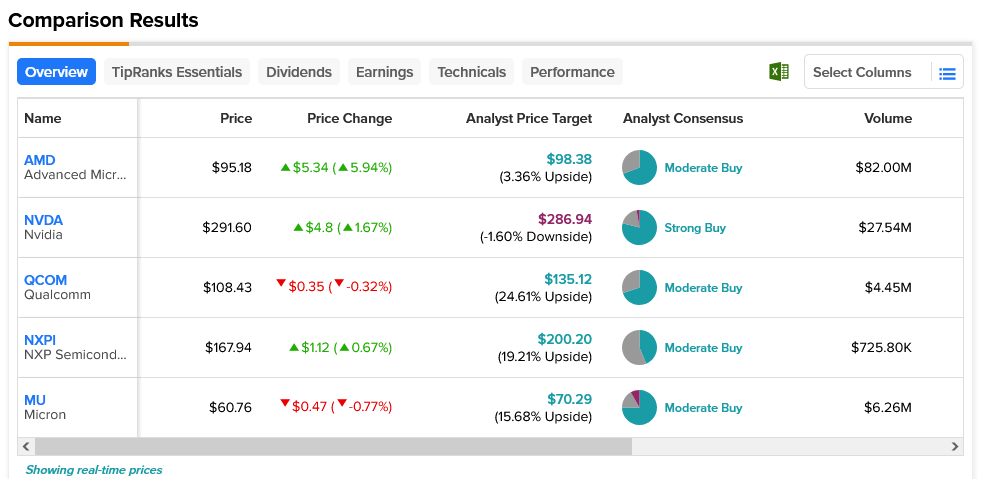

It wasn’t just AMD that gained here; Nvidia (NASDAQ:NVDA) was up over 1.6%, and NXP Semiconductor (NASDAQ:NXPI) also gained fractionally. Oddly, some chipmakers were down despite the gains from AMD. Qualcomm (NASDAQ:QCOM) slipped under half a percent, while Micron (NASDAQ:MU) lost just over 0.75%. These losses were attributed to some potential changes in supply chains at Apple (NASDAQ:AAPL) and a milder Chinese recovery.

Yet even as AMD branched up, it proved neither the best nor worst case among these stocks. Nvidia, considered a Strong Buy by analyst consensus, offers 1.6% downside risk thanks to its average price target of $286.94. Meanwhile, Qualcomm, one of the only chipmakers down today, is rated as a Moderate Buy but offers 24.61% upside potential thanks to its average price target of $135.12 per share.