As the Q3 earnings season gathers pace, investor attention remains on leading AI stocks. Major investments, new deals, and product launches are keeping the spotlight on companies turning AI innovation into real revenue. In this current scenario, Advanced Micro Devices (AMD) and Palantir Technologies (PLTR) stand out as two key names to watch, one powering the chips behind AI systems and the other building the software that puts them to work. Here, we used TipRanks’ Stock Comparison Tool to see which stock analysts view as the stronger pick ahead of their Q3 earnings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Advanced Micro Devices (NASDAQ:AMD) Stock

Advanced Micro stock has climbed more than 46% over the past month and 93% year-to-date, driven by strength in its data center business and optimism over its expanding role in the AI chips market. Its new deals with OpenAI (PC:OPAIQ) and Oracle (ORCL) show strong demand for AMD’s chips from leading AI players. With these wins, analysts on Wall Street stay upbeat, and the average price target points to more gains ahead, despite the stock’s big run.

Looking ahead, the company is set to report its Q3 2025 earnings on Tuesday, November 4. Wall Street expects AMD to report earnings of $1.17 per share for Q3, up 27% from the year-ago quarter. Meanwhile, analysts project Q3 revenues at $8.74 billion, up 28% year-over-year.

Ahead of the Q3 results, top HSBC analyst Frank Lee raised his price target to a Street-high $310 from $185 and reaffirmed his Buy rating on AMD stock, calling AMD one of the strongest beneficiaries of the growing AI infrastructure boom. The analyst believes most investors still underestimate AMD’s potential. “We think the Street has undervalued AMD’s AI GPU business,” he wrote, noting that his forecasts are 50% higher than consensus for 2026 and 45% above for 2027. He also sees room for higher pricing and more chip shipments as AI adoption spreads.

Palantir Technologies (NASDAQ:PLTR) Stock

Palantir Technologies stock has soared 135% so far in 2025, driven by rising demand for its AI-powered platforms, major government contracts, and a solid balance sheet. Recently, the company partnered with data cloud leader Snowflake (SNOW) to help government and commercial clients build more reliable data pipelines and speed up analytics. Following strong Q2 results, PLTR raised its 2025 revenue outlook to $4.14–$4.15 billion, backed by broad growth across both business segments. However, despite the strong momentum, Palantir’s high valuation continues to be a concern, and Wall Street remains cautious on the stock.

Looking ahead, Palantir is scheduled to report its Q3 2025 earnings on Monday, November 3. Wall Street expects Palantir to report earnings of $0.17 per share for Q3, up 70% from the year-ago quarter. Meanwhile, analysts project Q3 revenues at $1.09 billion, up about 50% year-over-year.

Ahead of the Q3 print, Piper Sandler analyst Clarke Jeffries described Palantir as a “secular winner in the AI revolution.” The analyst believes the company’s growth story is far from over, with momentum expected to stay strong. The upcoming earnings report could be a key catalyst, as investors look for signs that Palantir can sustain its AI-driven growth while remaining profitable.

AMD or PLTR: Which Stock Offers Higher Upside, According to Analysts?

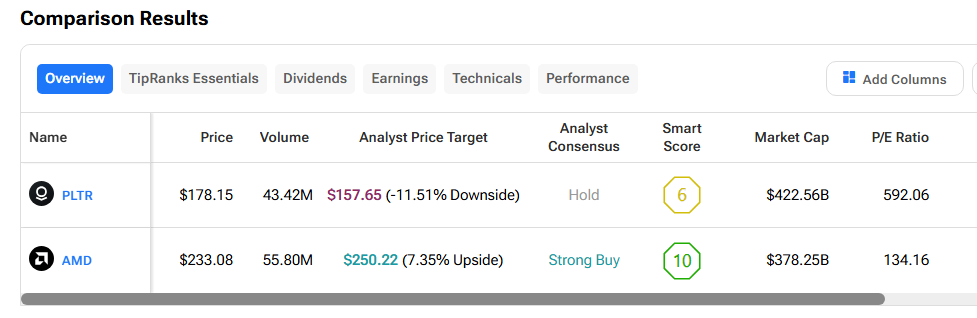

Using TipRanks’ Stock Comparison Tool, we compared AMD and PLTR to see which AI stock analysts favor. AMD carries a Strong Buy rating with a price target of $250.22, suggesting about 7% upside potential. In contrast, Palantir holds a Hold rating, with analysts’ average price target of $157.65, implying roughly 11% downside from current levels.

Conclusion

Both AMD and Palantir remain central players in the AI race. However, Wall Street clearly favors AMD ahead of Q3 earnings. Analysts see more upside in AMD’s expanding AI chip business, backed by strong partnerships and rising demand, while Palantir faces valuation concerns despite solid growth.