Semiconductor major Advanced Micro Devices (NASDAQ:AMD) is planning to invest nearly $400 million in a new campus in Bangalore, a tech hub in India.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The campus is expected to be the largest design center for the company and is anticipated to create nearly 3,000 new engineering positions by the end of 2028. It is slated to open before the end of this year and the investment comes amid a slew of semiconductor-focused policy initiatives by the Indian government.

The company has had a presence in India since 2001 with a headcount of over 6,500 at present. Separately, AMD is also scheduled to announce second-quarter numbers on August 1 and is largely expected to post an EPS of $0.57 on revenue of $5.32 billion for the period. In the comparable year-ago quarter, it had delivered an EPS of $1.05, surpassing expectations by $0.02.

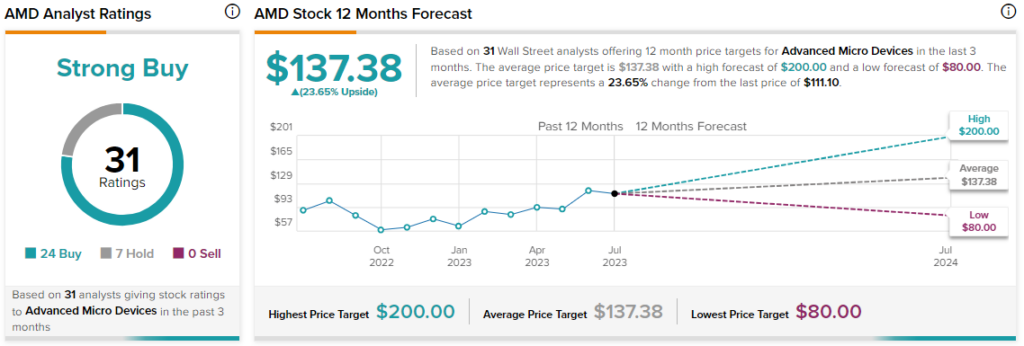

Overall, the Street has a $137.38 consensus price target on AMD alongside a Strong Buy consensus rating. This points to a nearly 23.6% potential upside in the stock on top of a 47.3% price surge over the past six months.

Read full Disclosure