The rise of AI represented the biggest trend of 2023 and was behind much of the outsized market gains. However, its advance is not based on mere hype.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Gus Richard, a top analyst at Northland, who’s in the top 1% of Street experts, has a pretty bold take on AI. He calls it the “most important technology development since the internet gold rush.”

With AI taking center stage, certain companies have been well-positioned to take advantage, and prominent amongst them is chip giant Advanced Micro Devices (NASDAQ:AMD).

While peer Nvidia has quickly established a leading position in AI chips, Richard thinks that AMD’s MI300 represents a compelling competitor, positioning AMD as a strong alternative source for GPUs.

Richard reckons AMD’s AI/GPU market share in CY23 was at 1% and anticipates that will rise to 3% in CY24 (or $2 billion) and 4% in CY25 (or $3.7 billion).

By CY27, if AMD captures 20% of the AI/DC market, Richard estimates that AI alone could generate as much as $24 billion in revenue. It should be noted that AMD has a history of challenging segment leaders, with its datacenter market share vs. Intel increasing from 1% to 12% in just four years.

Richard also believes Nvidia is “starting to compete with its customers, likely accelerating AMD’s AI market share.” For instance, Nvidia leases its DGX servers to cloud service providers (CSPs) and offers DGX Cloud as a platform for AI training services to CSP customers. CSPs, in turn, host DGX Cloud. This approach, says Richard, “disintermediates the CSPs.” NVDA’s sale of AI training as a service binds customers to its platform and enables flexibility for customers to shift AI workloads between different CSPs or transfer them to on-premises environments. “We think this motivates companies like AWS, MSFT, and Google to find alternatives to NVDA,” says Richard.

Moreover, AMD’s open-source approach is probably an “effective counter“ to Nvidia’s proprietary hardware and software. “We are confident that AMD will achieve 20% of AI/GPUs,” the 5-star analyst summed up. “The question is how quickly that will occur.”

All told, Richard rates AMD shares an Outperform (i.e., Buy) along with a $168 price target, implying the stock has room for 21% growth over the next year. (To watch Richard’s track record, click here)

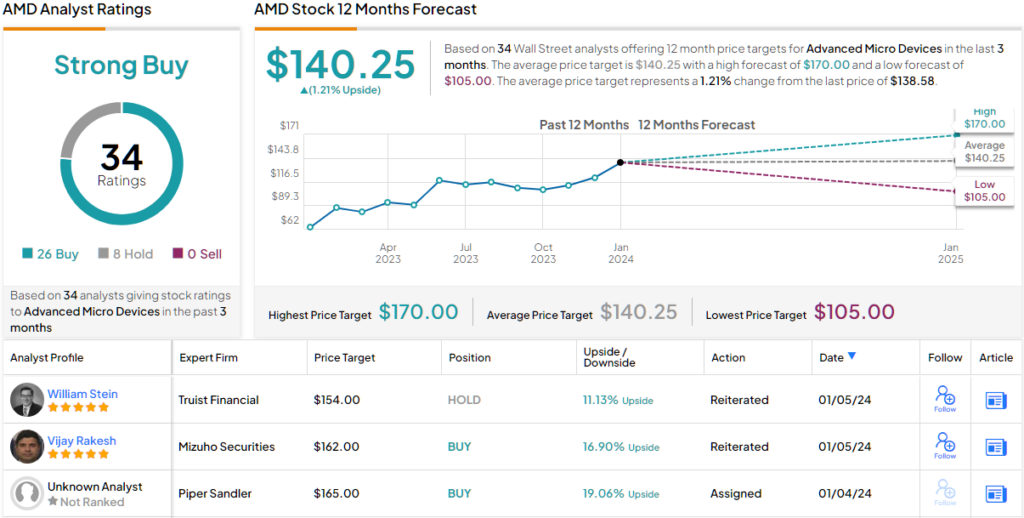

Most on the Street concur. Based on a mix of 26 Buys and 8 Holds, the analyst consensus rates AMD stock a Strong Buy. That said, the $140.25 average target suggests the shares will remain rangebound for the foreseeable future. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.