Advanced Micro Devices’s (NASDAQ:AMD) newest artificial intelligence chips, MI300, are likely to be used by Amazon’s (NASDAQ:AMZN) cloud division Amazon Web Services (AWS). The news was disclosed by AMD at its recent event conducted to highlight its AI strategy. Reuters writes that Amazon has yet to make a final decision.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AWS’s VP of elastic compute cloud, Dave Brown, stated, “We’re still working together on where exactly that will land between AWS and AMD, but it’s something that our teams are working together on.”

Furthermore, AMD’s latest AI technology will augment the company’s industry position as it plans to offer customers a wide range of pieces required to build systems for powering services like ChatGPT. It will give companies the ability to customize as per their needs in the data center. This will enhance AMD’s stance and its ability to compete against its industry rival, Nvidia (NASDAQ:NVDA).

How High is AMD Stock Expected to Go?

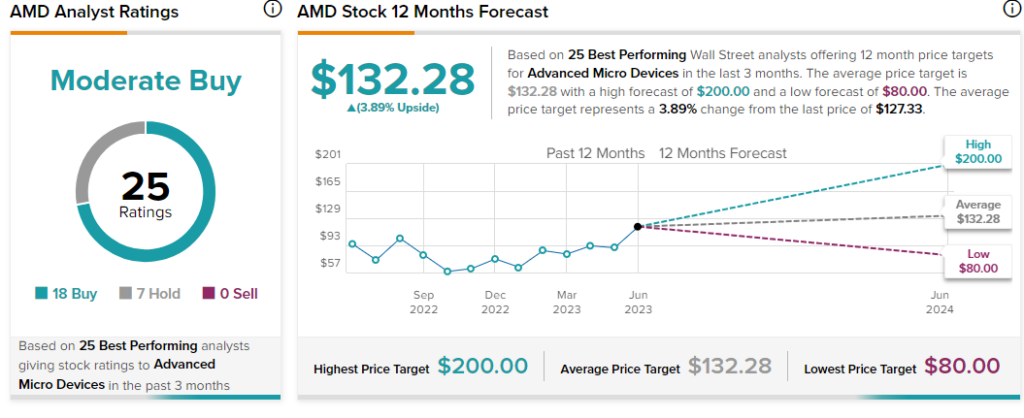

Of the 25 top Wall Street Analysts rating on the Advanced Micro Devices stock, 18 analysts rate it a Buy while the remaining have assigned a Hold. With a consensus rating of Moderate Buy, the average price target stands at $132.28, implying a 3.9% upside potential.

In the past three months, the stock has gained 42% while year-to-date the stock has collected 99% in returns. In yesterday’s single trading session, the stock gained 2.3%.

Post AMD’s Data Center & AI Technology Premiere event, a pack of analysts have raised their price targets on the stock yesterday. Goldman Sachs Analyst Toshiya Hari maintained his Buy rating with price target raised to $137 from $97, saying that the company is seen growing into a credible second supplier over the medium- to long-run.

The majority of the rating agencies believe that with the launch of multiple products and AMD enhancing its AI growth trajectory, the company has crafted a attractive AI revenue opportunity for itself in the upcoming quarters. Deutsche Bank, Barclays and Wells Fargo have raised price targets 38%, 61% and 25% respectively to $110, $145 and $150 respectively.

Particularly, Mizuho, with a 55% increase in price target to $140, estimates $1.1 billion in incremental artificial intelligence revenue for the company. Raymond James raises price target by 32% to $145 and states that with AMD working with numerous Tier 1 customers an initial AI revenue from MI300 is expected in Q4 of 2023.

Craig-Hallum analyst Christian Schwab reaffirmed a Buy rating and raised his price target to $158 from $100 as he believes AMD to be “well positioned for the transformational artificial intelligence megatrend.” The analyst notes that the event highlighted the total addressable market for artificial intelligence focused accelerators is estimated to grow from $30 billion in 2023 to over $150 billion by 2027.