Shares of Advanced Micro Devices (NASDAQ:AMD) are trading higher at the time of writing after unveiling a range of products and dropping some details on their AI-focused chip. This is likely to give Nvidia (NASDAQ:NVDA), a frontrunner in the generative AI space, a run for its money. As a result, Wells Fargo Securities was impressed enough to maintain its Buy rating on AMD and boosted its price target from $120 to $150. This came in the wake of AMD launching their Genoa-X and Bergamo (optimized for the cloud) Zen 4/4c EPYC server CPUs and giving a sneak peek of the MI300X GPUs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The AMD Instinct MI300 Series accelerator family stole the limelight at the “Data Center and AI Technology Premiere” event. They rolled out the AMD Instinct MI300X accelerator, claiming it to be the world’s most advanced accelerator for generative AI. CEO Lisa Su was all-in, dubbing AI as the “defining technology shaping the next generation of computing” and a major growth opportunity for AMD.

The MI300X, built on the next-gen AMD CDNA 3 accelerator architecture, boasts up to 192 GB of HBM3 memory, geared for large language model (LLM) training and inference for generative AI workloads. AMD also launched its Instinct Platform, a standard design incorporating eight MI300X accelerators for AI inference and training. Meanwhile, the AMD Instinct MI300A, the world’s first APU Accelerator for HPC and AI workloads, is now finding its way into customers’ hands.

Furthermore, there’s been some chatter that Amazon Web Services (AWS) (NASDAQ:AMZN) might be considering using the new AI chips from Advanced Micro Devices. Dave Brown, who heads AWS’ Elastic Compute Cloud division, hasn’t confirmed this, but he’s indicated that the two companies are indeed exploring potential collaborations. He also revealed that AWS decided against partnering with Nvidia for their DGX Cloud offering. While AMD has provided some tech specs for the AI chip, they’ve remained tight-lipped about their primary customer. So, it seems the tech world will have to wait with bated breath for the final word on this potential partnership.

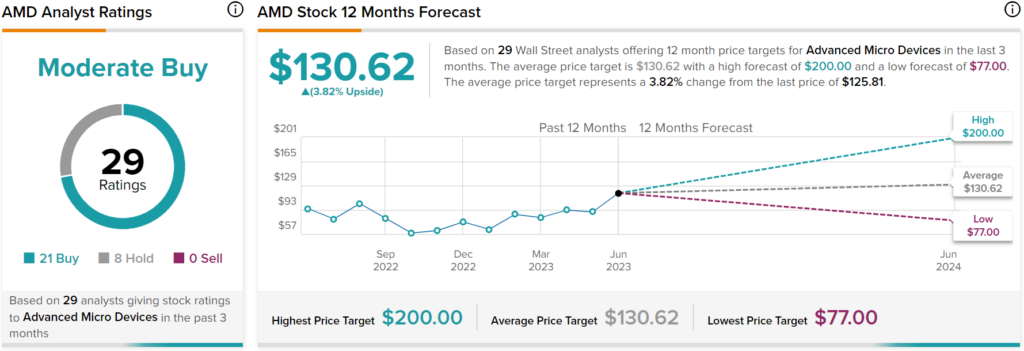

Overall, analysts have a Moderate Buy consensus rating on AMD stock based on 21 Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $130.62 per share implies only 3.82% upside potential.