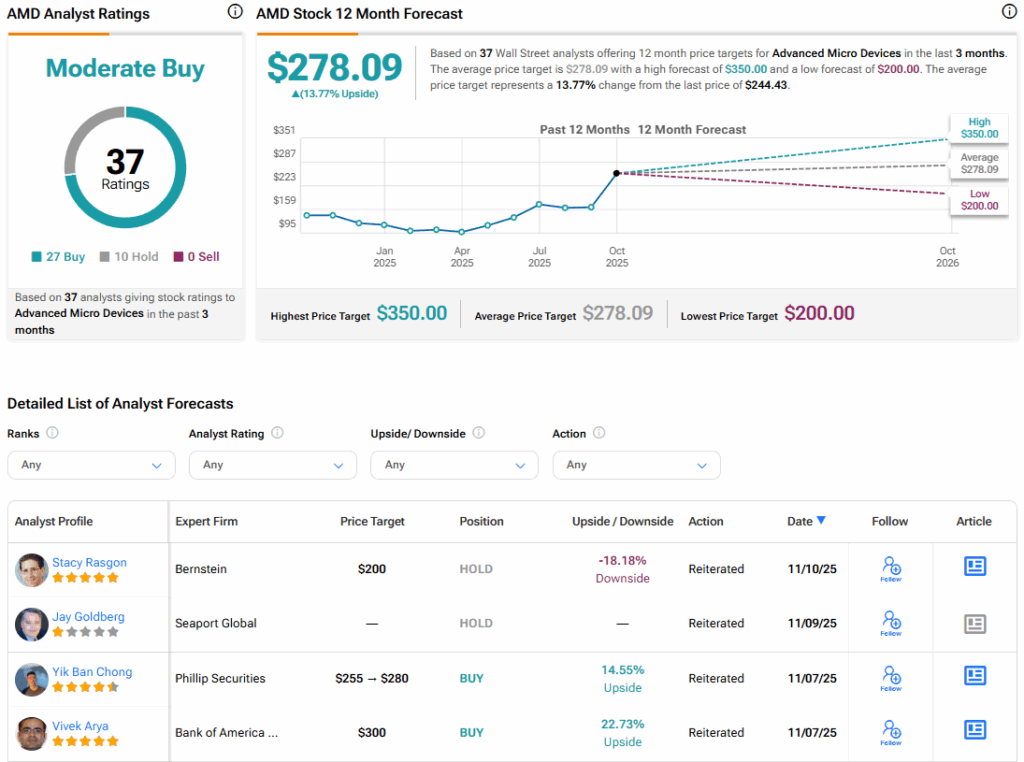

Advanced Micro Devices (AMD) stock rallied on Monday despite lukewarm coverage from a top Wall Street analyst. Five-star Bernstein analyst Stacy Rasgon reiterated a Hold rating and a $200 price target, suggesting a possible 18.47% downside for AMD shares.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Rasgon’s reason for his tepid stance on AMD stock has to do with its current market position and future prospects. While the analyst noted that AMD has improved its position against rival CPU maker Intel (INTC) and has strong potential in the artificial intelligence (AI) sector, he believes these changes are already more than priced into AMD stock. The analyst also expressed concerns about the AI market and how much value it holds for AMD.

Rasgon wasn’t the only analyst to update his coverage of AMD with an unenthusiastic stance. Seaport Global analyst Jay Goldberg maintained a Hold rating with no price target for the shares. The renewed Hold ratings come despite AMD’s strong earnings report last week, which triggered a large number of price target increases for the stock.

AMD Stock Movement Today

AMD stock was up 4.74% on Monday, despite the double Hold ratings from analysts. The shares have also rallied 102.53% year-to-date and 58.49% over the past 12 months. As noted by Rasgon, much of these gains have come from demand for AMD’s AI components.

Is AMD Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for AMD is Moderate Buy, based on 27 Buy and 10 Hold ratings over the past three months. With that comes an average AMD stock price target of $278.09, representing a potential 13.77% upside for the shares.