Advanced Micro Devices (AMD) stock rallied on Thursday alongside reports that the semiconductor company is in talks with Intel (INTC). According to a Semafor report, Intel wants to sign AMD as one of its Foundry customers. This would have some of AMD’s fabless chip production being handled by one of its biggest rivals. Currently, AMD’s fabless chips are produced by TSMC (TSM).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It makes sense that Intel would want to add AMD to its list of Foundry customers, as demand for its own chips has suffered. Additionally, it would provide AMD with the ability to manufacture chips in the U.S. This is of major interest to AMD after the COVID-19 lockdowns disrupted its overseas supply chain. It would also appeal to the company as it seeks more U.S. manufacturing following the introduction of tariffs on the tech industry.

While AMD is still behind Intel in processor market share, it has started to close that gap in recent years. This started with the introduction of its Ryzen chips, which have become popular among companies thanks to the similar performance they offer to Intel chips at a lower price. AMD also competes with Nvidia (NVDA) in the graphics processing unit (GPU) market, but has been much less successful at eroding its rival’s dominant position in that field.

AMD Stock Movement Today

AMD stock was up 2.79% on Thursday, extending a 39.99% year-to-date rally. The chipmaker’s shares have also increased 0.71% over the past 12 months. Much of these gains are related to the AI boom, though AMD has also performed well in the consumer PC parts market in 2025.

Is AMD Stock a Buy, Sell, or Hold?

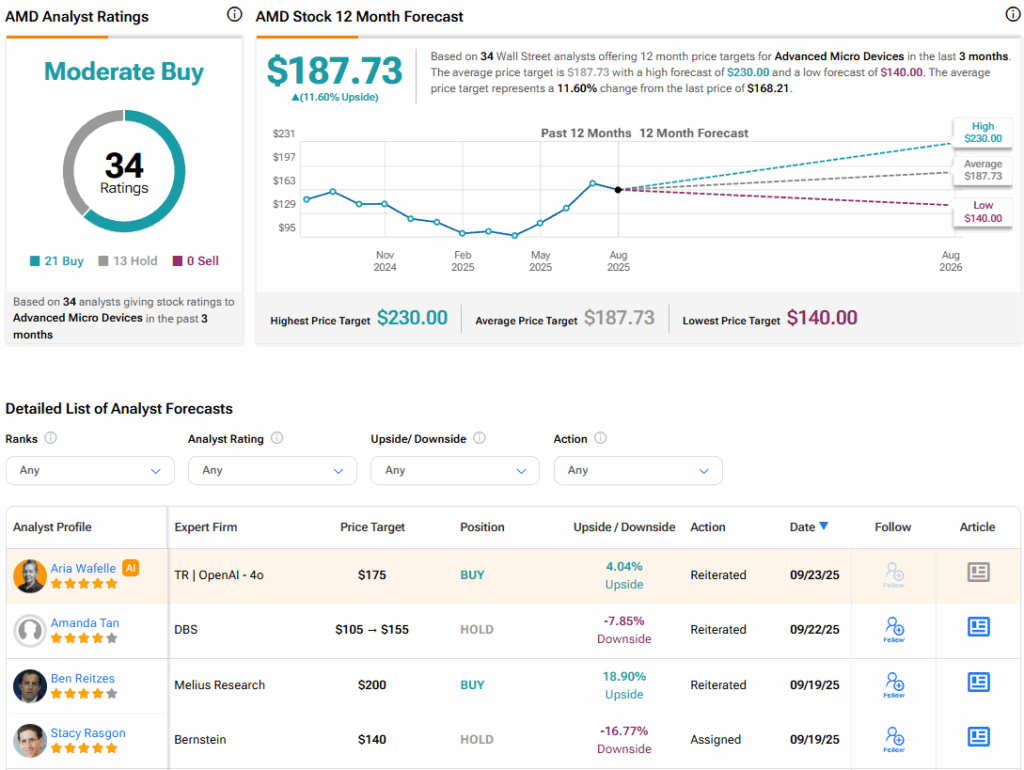

Turning to Wall Street, the analysts’ consensus rating for AMD is Moderate Buy, based on 21 Buy and 13 Hold ratings over the past three months. With that comes an average AMD stock price target of $187.73, representing a potential 11.6% upside for the shares.