Advanced Micro Devices (AMD) saw its stock jump more than 60% in October after the company announced a new deal with OpenAI (PC:OPAIQ). The rally marked AMD’s best month since 2001. The rise began on October 6 when AMD said it would supply OpenAI with six gigawatts of Instinct MI450 graphics chips over several years. The news sent shares up 34% in one day and added about $80 billion to the company’s market value. AMD shares are 112% year-to-date.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As part of the deal, OpenAI received a warrant to buy up to 160 million AMD shares at $0.01 each, which could give the company about a 10% stake. AMD said the partnership would boost its earnings and strengthen its position in the fast-growing market for AI hardware.

Earnings Lift but Guidance Holds Back Momentum

Later in the month, AMD posted its third-quarter results. Revenue rose 18% from a year earlier to $6.82 billion, beating Wall Street estimates. Earnings per share were $0.92, matching expectations. The company’s Data Center unit led the growth, with sales rising 122% to $3.5 billion due to strong demand for AI and server chips.

Chief Executive Officer Lisa Su raised AMD’s full-year forecast for AI chip sales to $5 billion. However, guidance for the next quarter came in slightly below analyst targets. AMD projected revenue of about $7.5 billion, just under the $7.54 billion that investors had expected. The miss caused the stock to fall around 7% after the report.

Competition and Next Steps

The company’s success with OpenAI and other large clients such as Oracle (ORCL) shows that AMD’s chips are gaining traction. Yet, the market for AI processors remains competitive. Nvidia (NVDA) still holds roughly 80% of the AI chip space, and AMD relies on Taiwan Semiconductor Manufacturing Company (TSM) to make its products, which limits supply.

Is AMD Stock a Buy?

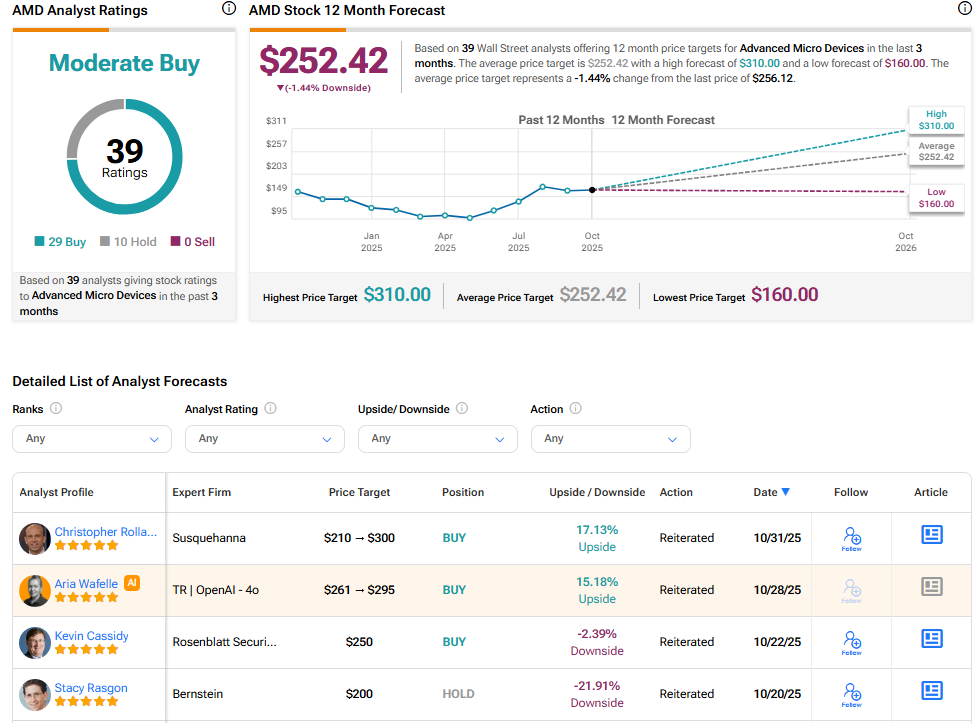

On the Street, Advanced Micro Devices boasts a Moderate Buy consensus rating. The average AMD stock price target stands at $252.42, implying a 1.44 downside from the current price.