Advanced Micro Devices (AMD) stock was on the rise Monday despite news that it has a new rival in the artificial intelligence (AI) data center sector. Rival chipmaker Qualcomm (QCOM) revealed new chips and server racks focused on capturing part of the booming AI industry. This will make it a direct competitor of AMD and AI component leader Nvidia (NVDA).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Qualcomm plans to start selling its AI chips and server racks next year. The company has also outlined plans for new AI CPUs that will be released in 2027 and 2028. This shows that the semiconductor company isn’t taking its step into the AI data center sector lightly, and for good reason. The field is already packed with companies seeking to get a piece of the AI pie. Some of the top players in the space are also huge in the consumer market, such as AMD, Nvidia, and Intel (INTC).

Interestingly, these new AI chips won’t be Qualcomm’s first attempt at entering the data center sector. It tried once before in collaboration with Microsoft (MSFT) in 2017. However, it failed to make substantial gains at that time due to Intel and AMD’s strong control of the market. Considering AMD and Intel have both seen strong support during the AI boom, Qualcomm’s second attempt to penetrate the data center sector could end the same way as the first.

AMD Stock Movement Today

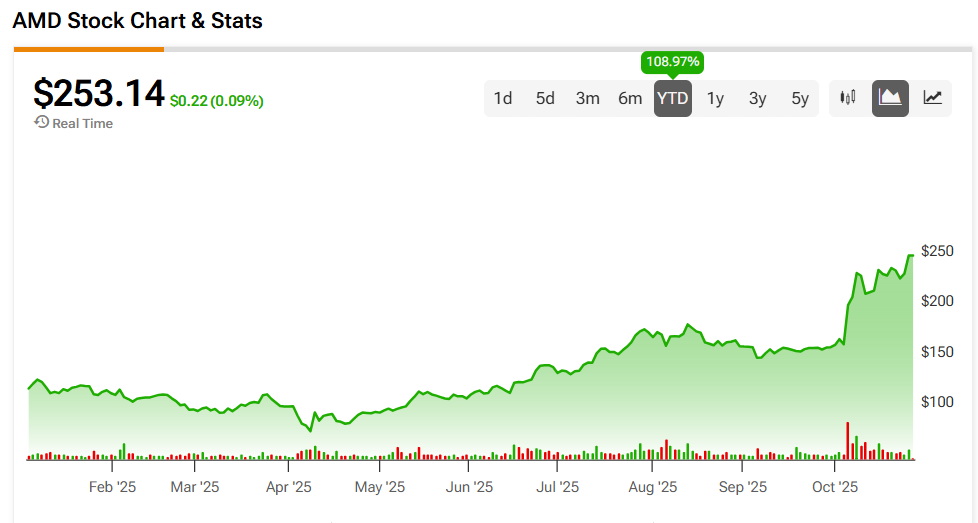

Investors in AMD stock weren’t concerned about Qualcomm’s plans to enter the AI data center market. As a result, AMD shares were up slightly on Monday, building on a 108.97% rally year-to-date. The stock has also increased 58.15% over the past 12 months.

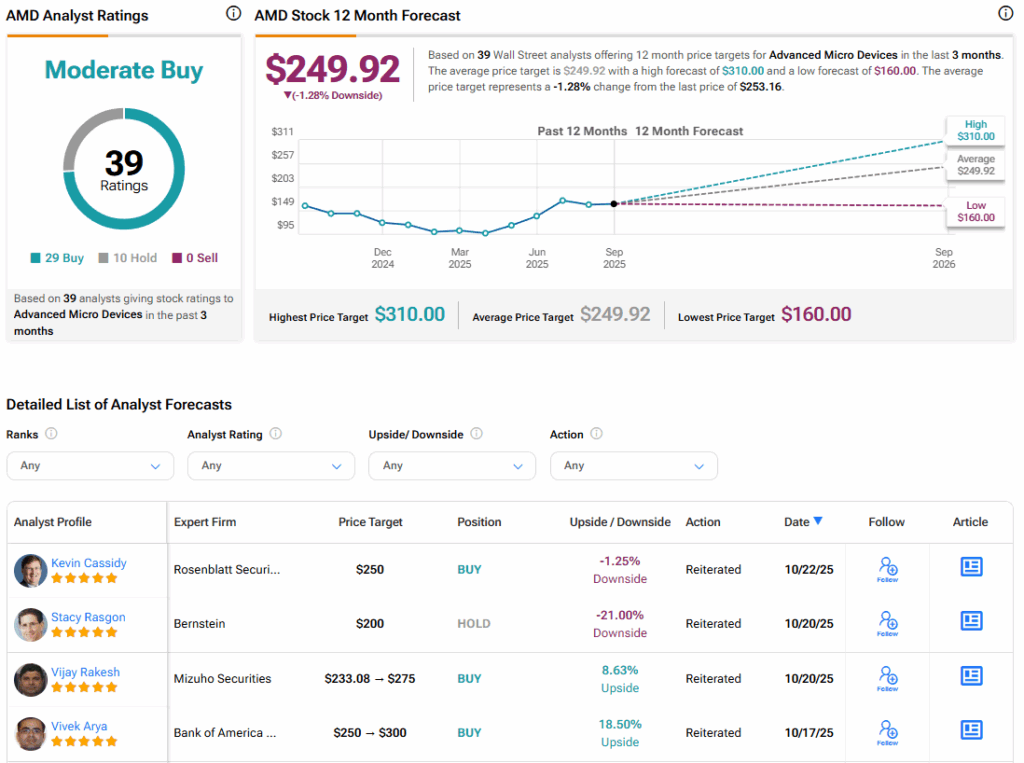

Is AMD Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for AMD is Moderate Buy, based on 29 Buy and 10 Hold ratings over the past three months. With that comes an average AMD stock price target of $249.92, representing a potential 1.28% downside for the shares.