After a sluggish 2024 – and an even weaker start to 2025 – Advanced Micro Devices (NASDAQ:AMD) has flipped the script to become one of the stock market’s standout success stories this year, with shares more than doubling over the past five months. While it still trails Nvidia by a wide margin in size and scale, AMD has firmly planted its flag in the center of the multibillion-dollar AI conversation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A recent partnership with OpenAI reflected the industry’s faith in AMD’s abilities, as the ChatGPT maker put a ring on AMD’s finger by contracting for the purchase of 6 gigawatts of computing power. Further aligning the interests of the two tech firms, OpenAI received warrants to purchase up to 160 million shares of AMD common stock as part of the deal.

This sets the stage as AMD prepares to release its Q3 2025 results after the bell on November 4. With momentum clearly building, one top investor thinks the positive trend could keep rolling after earnings hit the tape.

“If AMD announces massive computing capacity contract wins, then the stock could soar following the announcement,” says Keithen Drury, who is among the top 3% of stock pros covered by TipRanks.

Drury, however, offers a couple of caveats for this “incredibly expensive stock.”

For starters, AMD is coming off a disappointing Q2, one where its data center revenue only rose 14% year-over-year (and actually decreased by 12% sequentially). Needless to say, this pales in comparison with Nvidia’s 56% year-over-year (and 5% quarter-over-quarter) data center growth.

The OpenAI marriage, while an important development, was only announced in October and won’t be reflected in any Q3 figures. Moreover, OpenAI isn’t exactly exclusive with AMD, as it has even bigger (10 gigawatt) agreements with both Nvidia and Broadcom.

“I think this conveys that OpenAI was attempting to secure as much computing power as possible and was willing to make deals with every computing provider out there to make it happen,” Drury points out.

All that being said, the OpenAI deal could unleash a large backlog of orders for AMD. Any signs that this is occurring will be a key benchmark that Drury will be listening for during the call, though the investor intends to remain on the sidelines for now.

“I’m planning on staying patient with AMD stock until after Q3 results are reported,” sums up Drury. (To watch Drury’s track record, click here)

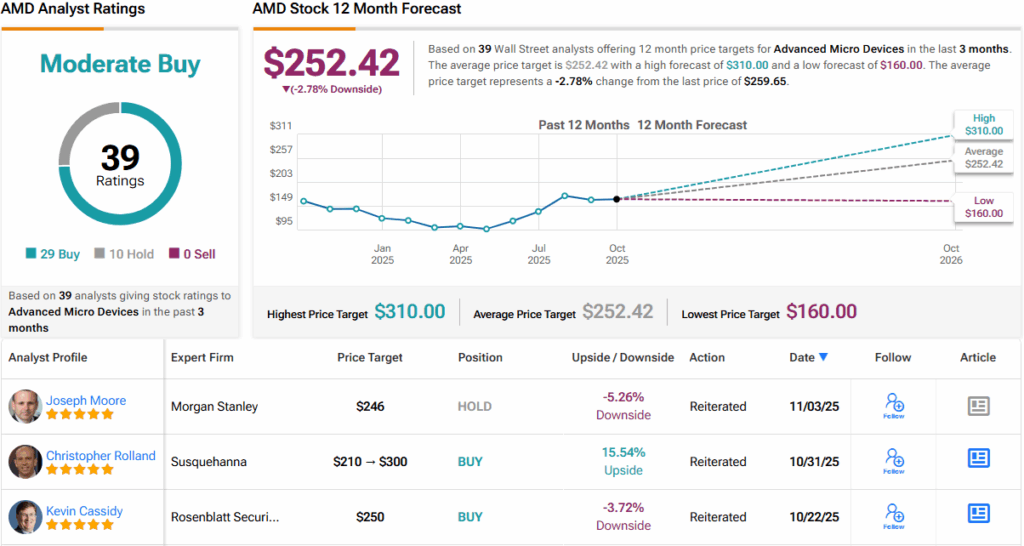

And what does Wall Street think? With 29 Buys versus 10 Holds, AMD sports a Moderate Buy consensus rating. Yet, the average 12-month price target of $252.42 points to modest down from here, a setup that suggests analysts may be sharpening their pencils for potential revisions once those Q3 numbers hit. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.