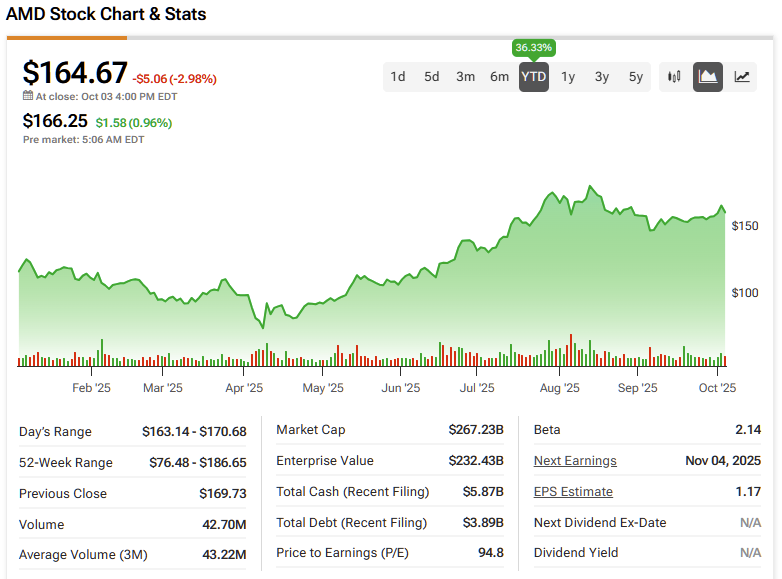

Advanced Micro Devices’ (AMD) stock has surged more than 35% year-to-date, driven by the same two letters fueling nearly every market narrative: AI. Investors have rallied around a straightforward story — accelerating data-center growth, expanding partnerships, and promising foundry moves that help de-risk the business. I like that setup.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, much of the good news already seems priced in. That means AMD must deliver, particularly in 2026, or today’s enthusiasm could deflate quickly. Last week’s sturdy 2% gain appears to have run into bullish fatigue around $170 per share and cannot make further progress. All things considered, I’m staying Neutral for now.

AI Engines Still Revving in the Data Center

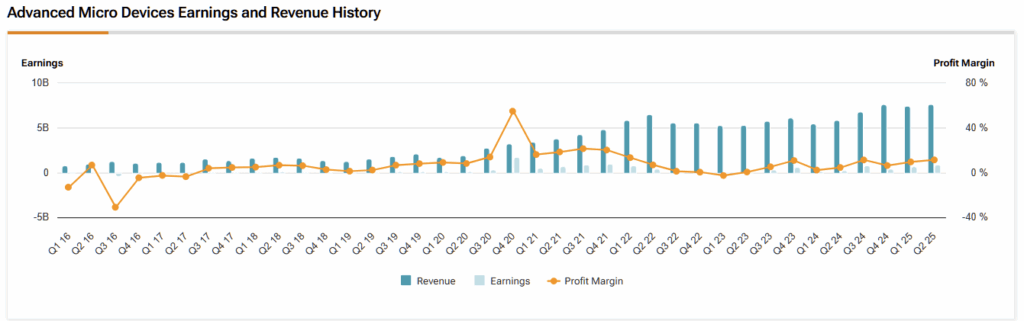

Here are a few baseline numbers for context. Last quarter, AMD delivered record revenue of $7.7 billion, a 32% increase year-over-year. Data Center sales rose 14% to $3.2 billion, despite U.S. export restrictions on older MI308 accelerators, which resulted in approximately $800 million in inventory and related charges. Management still projects Q3 revenue of roughly $8.7 billion at the midpoint, supported by a second-half ramp of the MI350 family and continued growth in EPYC CPU market share.

Beyond the print, the pipeline looks sturdier than a single quarter implies. At its Advancing AI 2025 event, AMD rolled out the Instinct MI350 GPUs, ROCm 7 software, and even previewed “Helios,” a rack-scale platform powered by next-gen MI400. The partner roll-call (Meta (META), OpenAI (OPAIQ), xAI, Oracle (ORCL), Microsoft (MSFT), Dell (DELL), Red Hat, and others) telegraphed that AMD isn’t selling chips in a vacuum, but stitching into full systems and software. That matters when the incumbent Nvidia (NVDA) owns the ecosystem.

We’re also seeing marquee wins line up. Oracle (ORCL) plans a zettascale AI cluster on OCI with up to 131,072 MI355X GPUs, one of the bigger public commitments to AMD silicon to date. If even a portion of that rolls on schedule, it cushions the MI350 ramp and broadens software adoption around ROCm. One nuance from Q2 is that the China pause for MI308s hurt, but the shift in mix toward EPYC CPUs carried the Data Center line anyway. If MI350 and MI355X volumes scale as guided in the back half, the segment will look less “CPU-saved” and more “GPU-led,” exactly what bulls want to see.

Partnerships Deepen, Foundries Flex

Importantly, AMD has been active in reshaping its supply and manufacturing posture, and, really, two headlines matter. First, AMD hit a milestone with TSMC (TSM) on N2 (2nm). The next-gen EPYC “Venice” CPU is up and running on N2, with validation also taking place at TSMC’s Arizona site. This satisfies the performance roadmap and geographic diversification AMD is looking for, two boxes investors love to see checked.

Second, multiple reports say Intel (INTC) is in early talks to add AMD as a foundry customer. It’s preliminary and may never close, but even exploratory discussions signal that AMD wants optionality beyond TSMC, especially as advanced packaging and geopolitical issues remain noisy. If realized, it wouldn’t replace TSMC. Instead, it would diversify risk and potentially unlock domestic capacity. For Intel, it would be a credibility win for its foundry push and for AMD, a supply hedge.

Speaking of packaging, the market is currently tight but is expected to ease. TSMC is doubling CoWoS capacity compared to 2024 levels, targeting roughly 70–75k wafers per month in 2025 and further growth into 2026, which appears to be good news for MI3xx/4xx availability and delivery schedules. Nevertheless, demand remains extremely high and can occasionally outstrip supply.

A Price That Presumes Perfection

But here’s the issue. At roughly $170 per share, AMD trades at ~43.6x this year’s EPS estimate, a rich multiple that assumes the AI ramp shows up, on time, in volume. If 2026 plays out as the Street models predict, the forward P/E falls toward the high-20s, which looks more palatable. But that “normalization” only happens if earnings actually scale.

And there are real ways the story can wobble. First, regarding policy, Q2’s $800 million hit from export controls was a stark reminder that Washington can reroute earnings with a single headline. Also, licensing changes would pinch margins and mix.

Second, CoWoS/HBM bottlenecks are easing, but not gone. Any hiccup in packaging or memory availability can disrupt deliveries at a time when AMD needs clean quarter-to-quarter growth. Lastly, Nvidia still sets the pace, and analysts continue to argue its ecosystem advantage remains intact even as AMD closes the gap with ROCm 7. If hyperscaler workloads remain CUDA-first for longer, AMD’s share gains could occur more slowly than the stock implies.

Thus, today’s multiple is a vote for flawless execution. If FY2026 consensus eases from “$6-ish” EPS or the MI350/MI400 roadmap slips, the equity can quickly re-rate because 40-plus times this year’s earnings doesn’t leave much room for stumbles.

Is AMD a Buy, Sell, or Hold?

Wall Street remains very bullish on AMD, despite the company’s strong year-to-date rally. The stock is now carrying a Moderate Buy consensus rating based on 22 Buy and 13 Hold ratings. Notably, not one analyst rates the stock a Sell. Currently, AMD’s average stock price target of $187.32 indicates ~14% upside from today’s levels.

AMD’s Future Looks Bright as Valuation Leaves Little Room for Error

Overall, I like the trajectory AMD is on — with a more potent data-center mix, solid MI350 momentum, heavyweight partnerships, and meaningful progress in manufacturing and packaging. That said, the stock already reflects much of that optimism, trading at roughly 43× this year’s earnings, with any “normalization” hinging on next year’s execution. In a market this sensitive, even a modest guidance cut could compress AMD’s multiples.