‘Show me the money,’ said Cuba Gooding Jr. in Jerry Maguire – and that sentiment resonates strongly with stock investors. In recent years, the rapid growth of AI has been doing exactly that, with long-term projections looking equally impressive.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The global AI processor chip market, for instance, was valued at roughly $123 billion last year and, according to Precedence Research, is expected to climb to as much as $325 billion by 2032.

That’s solid growth, and it has opened up plenty of opportunities for investors to cash in. Two of the best places to look for those opportunities are in the North American segment, which last year accounted for 40% of the global AI processor market, and in the GPU segment, which last year accounted for 60% of the AI-capable processor chips. If you want AI to show you the money, this is where to look.

One top analyst is doing just that. Rosenblatt’s Kevin Cassidy, who is rated by TipRanks among the top 1% of Wall Street’s stock experts, has taken a deep dive behind the scenes at Advanced Micro Devices (NASDAQ:AMD) and Intel (NASDAQ:INTC) – and he’s determined which of these AI chip stocks is the right one to buy, and which one investors should dump. Let’s take a closer look.

AMD

AMD has been something of a rising star over the past half year, driven by mounting enthusiasm around its expanding role in the AI chip arena. The company’s MI300 series has positioned it as a credible challenger to Nvidia in the lucrative data center and AI accelerator markets, drawing strong demand from major players. At the same time, AMD has continued to post solid revenue growth and improve its margins, reinforcing investor confidence. Shares in AMD have gained an impressive 95% year-to-date.

AMD’s fast expansion is reflected in a series of high-profile deals the company announced just this month. On October 6, the company revealed a strategic partnership with OpenAI, the AI developer that brought us ChatGPT in 2022 and helped ignite the current AI boom. Under the agreement, AMD will provide the AI company with 6 gigawatts of APUs to power the next generation of OpenAI’s infrastructure. The first deployment of the new AMD chips, 1 gigawatt of Instinct MI450 GPUs, is planned for 2H26.

Just a week later, AMD and Oracle together announced an expansion of their existing multi-generational collaboration. The expansion involves the deployment, starting in 3Q26, of up to 50,000 AMD GPUs for Oracle, a deployment that will power the launch of a publicly available AI supercluster.

And AMD wasn’t done yet. On the same day, it took the wraps off its new Helios rack-scale platform – built on Meta’s Open Rack Wide (ORW) specification – marking another leap toward open, interoperable AI infrastructure.

Together, these moves highlight how AMD is establishing itself as a strong player at the leading edge of the AI expansion.

The company will release its Q3 results early next month, but when we look back at 2Q25, we find that AMD’s top line, $7.685 billion, was up 32% year-over-year and beat the forecast by $255 million. This revenue total included data center sales of $3.2 billion. At the bottom line, AMD’s earnings were listed as a non-GAAP EPS of 48 cents, meeting analyst expectations.

Top analyst Cassidy, in his write-up of AMD for Rosenblatt, is impressed by the company’s recent deal announcements and strong results, and expects that AMD will continue to deliver.

“Heading into Q3 results, we expect AMD to deliver a modest beat-and-raise quarter, supported by improving client and server unit shipments and ongoing data center share gains, while we look for commentary on AI accelerator ramp timing, CPU trends, and Helios rack-scale adoption. We expect AMD’s results and guidance to reinforce confidence in its data center momentum and upcoming product ramps. Recent partnerships with OpenAI and Oracle reinforce AMD’s position as a core compute supplier for frontier-scale AI infrastructure, supporting our constructive view into 2H25 and beyond. We believe upbeat commentary around Instinct GPUs, ROCm software, and the Helios rack-scale platform could drive shares higher post results,” Cassidy noted.

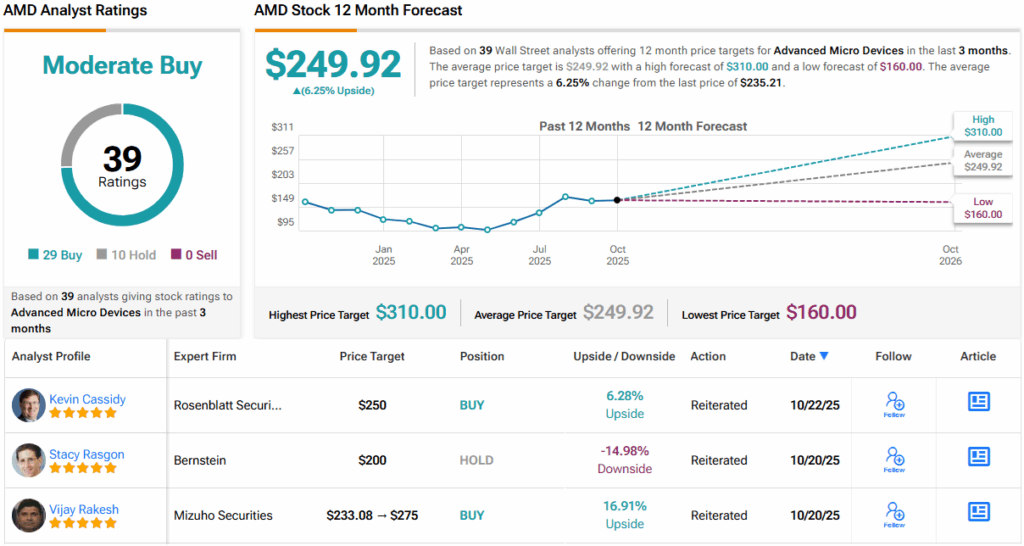

These comments support the analyst’s Buy rating on AMD shares, though his $250 price target implies a modest 6% upside, reflecting confidence in AMD’s execution rather than expectations of sharp near-term gains. (To watch Cassidy’s track record, click here)

Overall, AMD holds a Moderate Buy consensus based on 39 recent analyst reviews, with 29 Buys and 10 Holds. (See AMD stock forecast)

Intel

Intel has long been synonymous with PC processors, but has struggled to adapt quickly to the AI era. While the company maintained its dominance in traditional computing chips, it was slower than rivals to pivot toward AI-optimized products.

That said, Intel isn’t out of the fight. Despite the competitive pressure, the company still holds valuable assets and the financial backing to mount a serious comeback. In recent months, it has secured large-scale government support, including an $8.9 billion stock purchase by the Trump Administration in August, bringing the U.S. government’s total investment in Intel, through stock and direct grants, to $11.1 billion, alongside a $2 billion infusion from Japan’s SoftBank.

This influx of capital is part of a broader effort to revitalize Intel’s strategic position. The company aims to reestablish itself as America’s leading onshore foundry, a key priority of the Trump Administration’s push to repatriate high-tech manufacturing. As the only major chipmaker with significant U.S.-based fabrication facilities, Intel is doubling down on modernizing and expanding this capacity to become a major third-party supplier in the domestic semiconductor supply chain.

Intel’s newest fab plant in Arizona is set to begin production later this year on the Core Ultra Series 3, codenamed Panther Lake. Built on the company’s 18A architecture, the chip represents a technological milestone – what Intel calls “the most advanced semiconductor process ever developed and manufactured in the United States.”

Meanwhile, Intel isn’t working alone. In September, it announced a collaboration with Nvidia to co-develop multiple generations of custom products for data centers and PCs. The partnership seeks to combine Intel’s CPU expertise with Nvidia’s leadership in AI and accelerated computing, aiming to deliver next-generation processor solutions that could help Intel regain relevance in the AI race.

We won’t know how that works out until Intel starts reporting next year’s financial results. The company’s next earnings release, scheduled for today after the markets close, will cover 3Q25; analysts are expecting revenues of $13.1 billion and adjusted EPS of $0.01 per share.

But not everyone’s optimistic. Kevin Cassidy is urging caution, pointing to the serious challenges Intel still faces and warning that a true turnaround may take more time than investors hope.

“We maintain low expectations for Intel’s upcoming earnings, with estimates modestly below consensus for both Q3 and Q4 as the company continues to face structural and execution challenges. With share losses in PCs and servers showing few signs of stabilizing, investor expectations riding on yet-to-be-proven 18A products, and foundry traction still more speculative than tangible, we see little evidence that the company is meaningfully altering its competitive trajectory. The key debate is less about near-term results and more about whether Intel can stabilize its competitive position and return to growth beyond 2025. Given limited visibility into 18A execution, foundry traction, and market share stabilization, we believe the risk/reward remains unfavorable,” Cassidy opined.

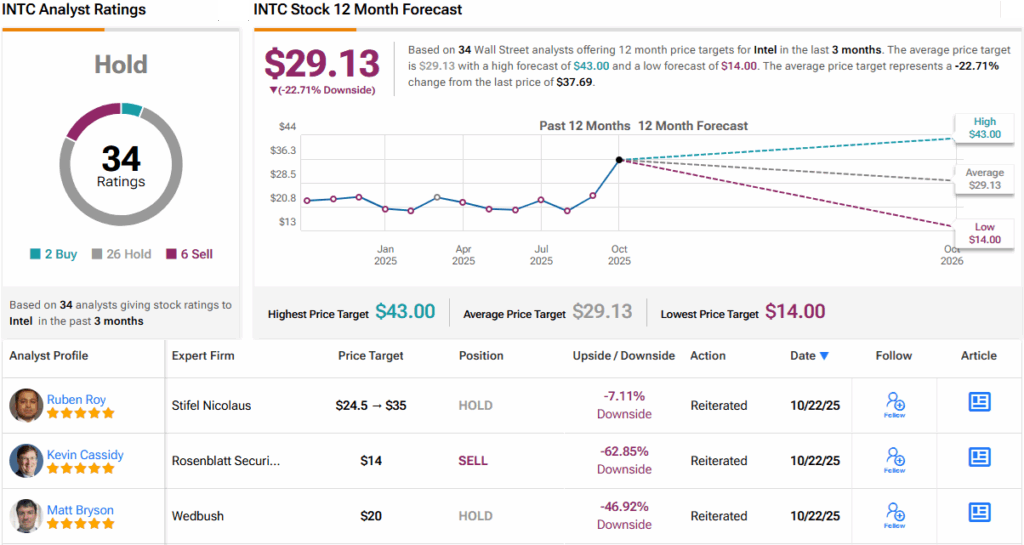

To this end, the Rosenblatt analyst rates INTC shares as a Sell, and his price target of $14 implies that the shares will lose ~63% by this time next year.

All in all, Intel’s stock has a Hold (i.e., Neutral) rating from the analyst consensus, based on 34 recent analyst reviews that break down to 2 Buys, 26 Holds, and 6 Sell ratings. The shares are currently trading for $37.72, and their $29.13 average price target suggests a one-year downside of 23%. (See INTC stock forecast)

After laying out the facts and looking at these chipmakers’ prospects, it’s clear that top analyst Kevin Cassidy sees AMD as the right AI-related chip stock to buy right now.

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.