Shares of Advanced Micro Devices (AMD), Nvidia (NVDA), and Intel (INTC) fell on Friday as investors grew cautious over supply concerns about rare earth materials, a key component in the chipmaking process. The pullback came amid reports that China has tightened export rules, requiring government approval for rare earth shipments tied to semiconductor use.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The move is seen as part of Beijing’s broader effort to strengthen control over its rare-earth mineral resources. China refines the majority of the world’s rare earths, which are critical to manufacturing chips, electric vehicles, and advanced computing systems. The new export review process could slow deliveries and increase production costs for chipmakers that rely on Chinese suppliers.

Market Reaction and Outlook

On Friday, AMD shares fell 7.7%, marking one of the sharpest single-day declines for the stock in recent weeks. Nvidia also slipped 4.9%, while Intel lost around 4% as investors reacted to concerns over rare earth supply controls from China.

Despite the pullback, AMD stock remains up 78% year-to-date and has climbed over 30% in the past 12 months, supported by strong demand for AI and data center chips. Nvidia shares have gained about 36% so far in 2025 and 33% over the past year, maintaining their lead in the AI chip market. Meanwhile, Intel stock has risen 81% year-to-date as the company expands its U.S. manufacturing operations and foundry services.

Analysts believe the drop appears to be driven by supply worries rather than weaker fundamentals. All three chipmakers remain key players in the global semiconductor race, though rare earth export restrictions could temporarily weigh on production costs and investor sentiment.

AMD vs. NVDA vs. INTC: Which Chip Stock Do Analysts Prefer?

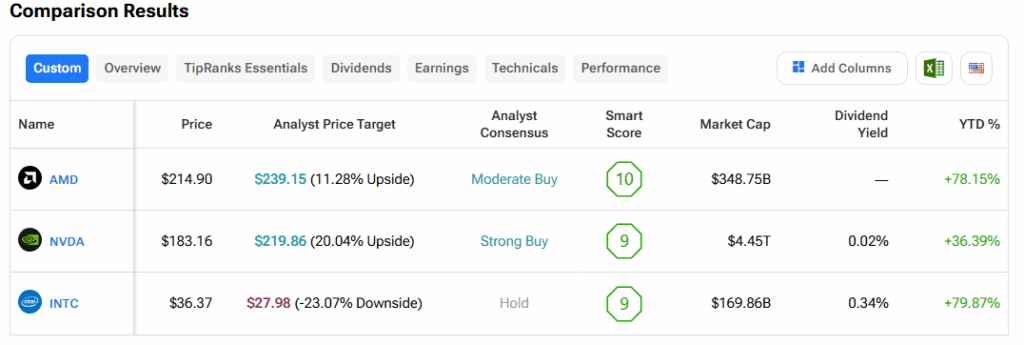

Turning to the TipRanks stock comparison tool, analysts show the strongest confidence in Nvidia, which holds a Strong Buy consensus rating and a 20.04% upside potential based on an average price target of $219.86. Meanwhile, AMD holds a Moderate Buy with an 11.28% upside, while Intel carries a Hold rating and a projected 23.07% downside.