Semiconductor stocks, which had been under pressure earlier this month amid renewed US–China trade tensions, rebounded sharply on Monday after signs of progress toward a potential deal. The VanEck Semiconductor ETF (SMH) rose 2.5% to $359.94, recovering from a steep 6% slide on October 10, its worst one-day loss since April.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts, including Wedbush Securities analyst Dan Ives, said easing trade concerns could spark a “tech rebound,” lifting chipmakers that were hit hardest by tariff worries. As optimism returns, leading names are gaining ground — Advanced Micro Devices (AMD) climbed 2.7% to $259.35, Nvidia Corporation (NVDA) rose 2.8% to $191.57, and Broadcom Inc. (AVGO) added 2.2% to $363.52. Intel Corporation (INTC) — which earns about 30% of its revenue from China — rallied 3.2% to $39.60, while Micron Technology (MU) edged 0.5% higher to $219.33.

Chip Equipment Makers Join the Rally

The recovery extended to semiconductor equipment names that had been under pressure due to their high exposure to China. Applied Materials (AMAT) rose 1.1% to $232.14, while Lam Research (LRCX) jumped 3.4% to $157.60. Design software maker Cadence Design Systems (CDNS), which has faced fluctuating restrictions on its China operations, also gained 1.9% to $346.50.

Analysts See Potential Turning Point for Tech

Ives said the renewed trade talks could mark a “groundbreaking moment” for the tech sector if they lead to a lasting deal. The 5-star analyst noted that months of tariff threats and export limits have been “a heavy drag on investor sentiment,” especially for chipmakers and AI-focused companies.

Ives added that a trade agreement could “lift one of the biggest overhangs on tech,” opening the door for fresh gains across the AI, semiconductor, and software space. Other analysts share this view, saying a truce would ease supply chain strain and steady chip sales to China — a key market for the industry.

With the holiday season nearing and AI demand still strong, investors believe top names like AMD, Nvidia, Intel, and Broadcom could build on their recent momentum if trade talks continue on a positive track.

Which Chip Stock Is the Best Buy?

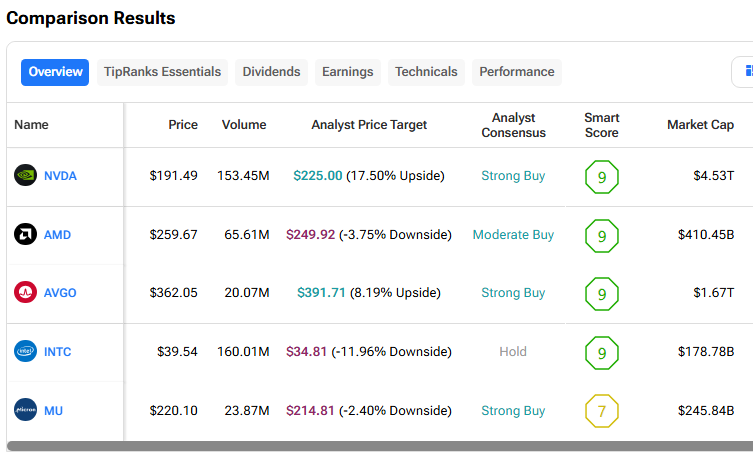

Among these five major chipmakers, Nvidia leads with the strongest outlook. Analysts rate it a Strong Buy with a $225 price target, implying about 17.5% upside.

Broadcom also carries a Strong Buy rating, with roughly 8% upside, while Micron is rated Strong Buy but shows a small 2% downside. Meanwhile, AMD holds a Moderate Buy rating and a 3.7% downside, and Intel remains a Hold with a 12% downside.