When chip stock Micron Technologies (NASDAQ:MU) announced its financial guidance, investors and analysts alike started to get concerned about the entire semiconductor market. However, a new report in from AMD (NASDAQ:AMD) suggests that the problem isn’t as sector-wide as was thought. That optimism sent AMD careening upward over 4.5% in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Word from Matt Bryson with Wedbush Securities notes that Micron’s forecast, so far, looks “extremely conservative,” especially given how the market for memory chips seems to be coming back. Several other analysts stepped in to provide some positive analysis on the chip sector as a whole, and AMD led the way up with several other firms—including Western Digital (NASDAQ:WDC) and Texas Instruments (NASDAQ:TXN)—also making gains in the field.

Meanwhile, AMD is carrying on with its vast and growing array of hardware. This includes its data center chip lines, its consumer-grade graphics processors, and, of course, the Ryzen 7040, a client-facing CPU with a focus on PC hardware.

Is AMD a Buy or Sell Today?

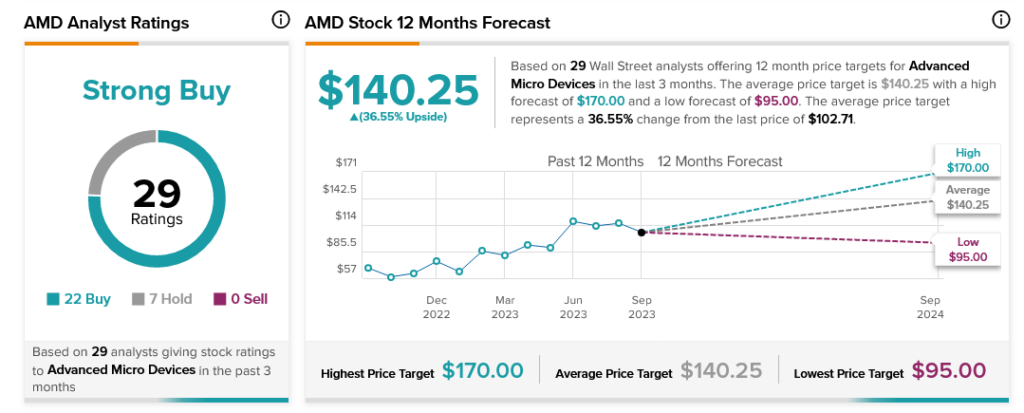

AMD enjoys no shortage of analyst support. AMD stock is currently rated a Strong Buy by analyst consensus, with 22 Buy ratings and seven Holds. Further, AMD stock offers investors 36.55% upside potential thanks to an average price target of $140.25.