October 2025 is heading into the history books, and, as always, there were many notable winning and losing stocks during the month.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In the winner’s circle is chipmaker Advanced Micro Devices (AMD), which gained 62% during the month. The company announced on Oct. 6 that it had entered a deal to become a major supplier of microchips and processors for OpenAI. The artificial intelligence (AI) deal propelled AMD shares to their best month since 2001.

Other winning stocks during October include names such as Micron Technology (MU), whose share price rose 36% in the last four weeks. Shares of Teradyne (TER) were close behind, jumping 33% in October to hit an all-time high. J.B. Hunt Transport Services (JBHT) enjoyed a strong rebound in October, with its shares gaining 25% after it posted impressive financial results and showed that it’s controlling costs.

Rounding out the five biggest winners in October is data-storage company Western Digital Corp. (WDC), whose share price increased 23% on robust demand for its storage hardware due to cloud computing and AI investments.

Not So Great

On the flipside, there were plenty of stocks that got knocked lower over the past month. Chief among them was Fiserv (FI), which was the worst performer in October as shares plunged nearly 50% after the financial technology company cut its full-year outlook, sending shares down 44% in a single day.

Other poor performers include Alexandria Real Estate Equities (ARE), a real estate investment trust whose share price fell 33% after the company swung to a loss in the third quarter; Molina Healthcare (MOH), which sank 21% in October after the health insurer reduced its full-year earnings guidance; and CoStar Group (CSGP), which fell 20.7% after it reported a net loss of $30.9 million.

Last but not least was cybersecurity firm F5 (FFIV), whose stock dropped 21% after the company disclosed it had suffered a major security breach that presented “an imminent threat to federal networks” in America.

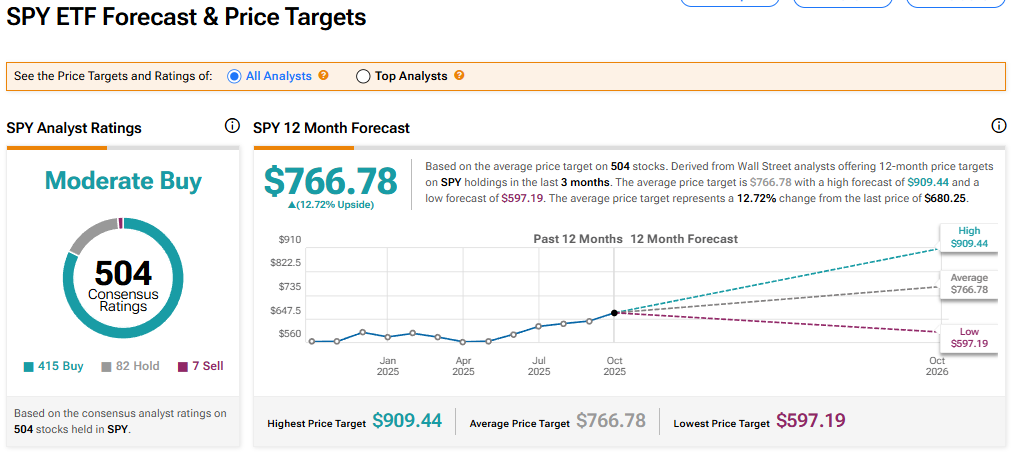

Is the SPDR S&P 500 ETF Trust a Buy?

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 415 Buy, 82 Hold, and seven Sell recommendations issued in the last three months. The average SPY price target of $766.78 implies 12.72% upside from current levels.