Subcontractors are often an important part of business. Trying to get everything done in a day can be tough, so spreading the workload around helps get more done. For computer hardware companies like AMD (NASDAQ:AMD), it’s no different. And AMD gained fractionally in Friday afternoon trading after revealing it might be considering a new subcontractor itself.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Normally, AMD would go through Taiwan Semiconductor (NYSE:TSM) to get its chips produced. But, with the global supply chain being what it is—and the worst of the semiconductor shortage likely still fresh in the minds of many—AMD was willing to consider other options. And one of those, according to AMD CEO Dr. Lisa Su, would be to look into other companies to produce chips. Su noted that AMD is out to make “…the most resilient supply chain,” and about the only way to do that is to ensure product flows regardless of circumstances.

This is reasonable enough, particularly in light of how big a deal AMD is these days. Dr. Su also noted, based on a report from Digitimes Asia, that AMD’s share of the global server GPU market is now just over 25%. When you’ve got that much of an entire global market under your umbrella, you don’t want to mess around and have companies considering other suppliers, so you look to be the biggest link in that supply chain and keep your own stuff constantly available.

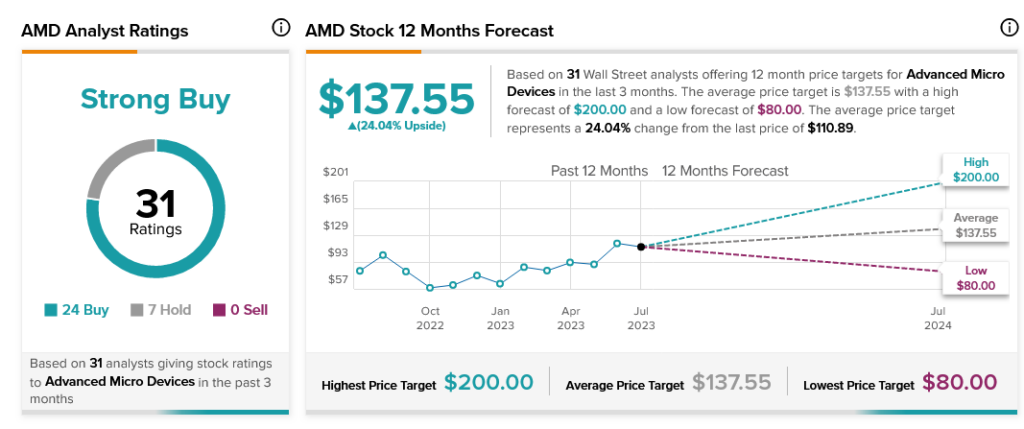

Such a strategy, and such a market, likely explains why AMD is such a hit with analysts. AMD is currently considered a Strong Buy with analysts, thanks to 24 Buy ratings and seven Hold. Further, with an average price target of $137.55, AMD stock offers its investors a 24.04% upside potential.